Ask any Insurance agents “Why they don’t prefer/suggest Term Insurance?”, their answer would be “There is no survival benefits”. Meaning: if you lived the entire term of the insurance, you won’t get back any of your money back. All the money you paid as premiums are for the insurance expense.

Lot of people think that argument is valid and end up paying lakhs of rupees as premium for a pathetic amount as sum assured in traditional plans. They feel that every money they pay for insurance should be returned to them.

Return of Premium Term Insurance

Some of these insurance companies have taken the hint and created a product called Return of Premium Term Insurance policies. It is just like any other term insurance policy – you pay premium every year for a higher sum assured. But at the end of the term, if you are alive, you get back all the premium you paid to the company.

I hear you saying “Thats great.” Hold your horses! For this additional feature, you end up paying higher premiums. Typically 4 to 5 time more than a normal term insurance.

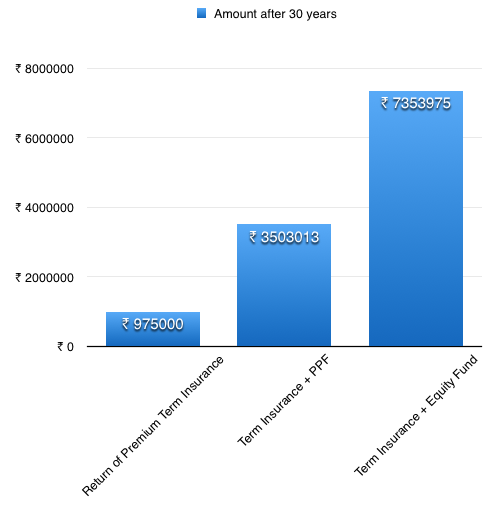

For example: lets say you are 30 years old and want to take an insurance policy for Rs.1 crore. If you opt for a Return of premium plan you might have to pay approximately Rs.32,500. At the end of 30 years if you are alive, the company would pay you back Rs.9.75 lakhs – the entire premium you paid. On the other hand, a plain Term insurance would cost you about Rs.7500 if taken online.

You may say, but this extra Rs.25,000 is not that bad right? One can get the best of both worlds. High sum assured for life coverage and also get back all the money they put in (even if they are willing to lose the interest for 30 years).

Lets see if we can beat this Rs.9.75 lakhs payback by taking just a plain term insurance and investing the remaining money somewhere else. Even if there is one safe investment that can beat this returns, this insurance product is a waste of your money. Our objective here is to invest Rs.25000 per year in some investment product and hope to get back more than Rs.9,75,000 at the end of year 30.

Public Provident Fund

Public Provident Funds or PPFs are the most safest way to invest and get tax benefits + tax-free returns. I have already talking about PPF earlier. The lock-in period of 15 years isn’t important as we are going in for the really long-term of 30 years. Lets see how much we will get after 30 years at the rate of 8.7% (current rate of interest).

In 30 years, by investing Rs.25,000 every year in a PPF account and extending the account till 30 years, a person would end up with Rs. 35,03,013. Rs. 35 lakhs. Compared to the Rs.9.75 lakhs this is so much more and also PPF accounts are backed by the Government of India, unlike your insurance company.

Equity Mutual Funds

Equity Mutual Funds are optimum for people who want to take a little bit more risk as it helps you earn better returns than any other asset class. Also invested for over 30 years, equity markets are the best investments which can provide inflation beating returns.

But lets not be too greedy for higher returns. Let us assume a very moderate and easily achievable 12% return. Note that I am not claiming 16% returns which is what Sensex has given over the really long period.

The important part to note here is we will be spreading our investments over 12 months x 30 years – in the form of a Systematic Investment Plan (SIP) to average out any volatility in the market.

Can you guess how much you will have at the end of 30 years by doing a SIP of Rs.2083.33 per month, earning a return of just 12%? Believe it or not, it is Rs.73,53,975. Rs. 73 freakin-lakhs is more than 7.5 times higher than your amazingly new “Return of Premium Term Insurance” policy that the company is trying to sell you. If you assume the usual long-term rate of return of 16%, you would get Rs.1.85 Crores.

Which route are you going to take?

I have laid out the numbers in front of you. You can check them out with the numerous calculators you have on the web. The options you have are very simple:

- Return of Premium Term Insurance at Rs.32500 per year and lose most of your premium to inflation? Rs.9.75 lakhs

- Plain Term Insurance (Rs.7500) + PPF (Rs.25000) and get back Rs. 35 lakhs

- Plain Term Insurance (Rs.7500) + Equity Mutual Funds and easily get back more than Rs.73 lakhs.

Next time some insurance agent comes to you and suggests you buy some revolutionary new product which will give you amazing returns, sit back and take out your calculator. Ask them to show how much returns their product gives and compare it to the returns an Equity Fund or the plain old trusty PPF gives. Let them beat PPF’s returns first, then we can think whether or not its revolutionary.

Always remember, life insurance is an expense and not an investment. If all things go well, you or your dependants shouldn’t ever get a cheque from your Insurance Company.

This analysis and results are very similar to the ULIP vs PPF vs Mutual Fund analysis I made earlier. You might also want to check that out too.