The first article under the Income Tax series was about Income Tax Slabs. Do go read it if you have difficulty calculating your taxes and the different slabs.

There are various sections under which we can claim tax deductions. And each has it’s own limits and uses. 80C is the most popular section under which people claim tax deductions. Even though I have written in brief about this section, it was in 2013 and a lot of things have changed since then.

Under this section 80C, Rs.1.5 Lakhs can be claimed for tax deductions. Money invested under this section enjoy tax deductions. They also have a long lock-in period attached to it.

There are other types of expenses that can also be claimed under 80 C and in this article I will explain in depth about what I consider to be the most important one – Life Insurance.

Life Insurance Policies are a must if you have dependents – spouse, children, parents, etc. It is double important if you have liabilities like home loan, car loan. The Insurance Policy makes sure that your dependents can maintain the same life style as they are currently enjoying even after your death.

There are lot of Insurance agents who sell policies without trying to mention the words “DEATH“. Death is the one certainty that can happen to anyone at any time. It is very important to not mince words and ensure that your dependents are well protected.

Life Insurance is needed for everyone who earns money in the family. Without their money, if you can’t lead the same lifestyle, then get that person insured.

- If you are the primary bread winner, get insurance.

- If your spouse also earns money, get insurance for him/her.

- If your children are still in school or college – don’t get insurance for them.

There are many insurance providers who sell insurance policies in the name of Children Savings policy.

These are just emotional words to get your money.

When your child earns his own money, he can get himself insured. Till then, it is not needed.

The only difference is if you child earns the money in your family as an artiste and you are dependent on him/her, then you need to get them insured.

What Life Insurance Policy to buy?

Always buy a Term Insurance policy.

End of discussion.

Go on to the next section.

Ok. You are still here? Want to know why I said Term Insurance?

Lets see the dictionary definition of Insurance

Insurance

an arrangement by which a company or the state undertakes to provide a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a specified premium.

See how the dictionary definition doesn’t have any word called investment or savings? Term insurance is the only true life insurance policy that strictly follows the dictionary definition.

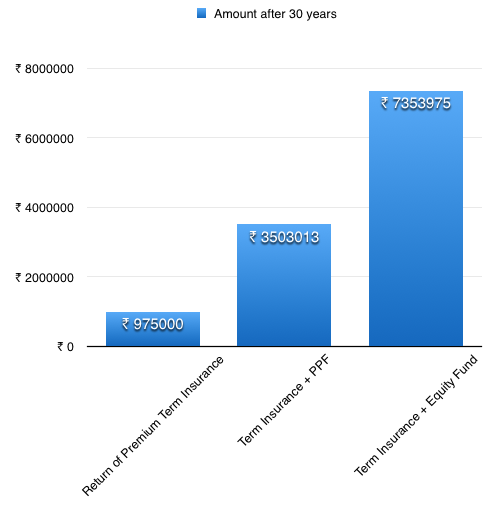

You should never mix insurance and investment. Both are completely different and should remain separate. Since term insurance is just a pure insurance product, you get more value for your money.

How much Insurance do you need?

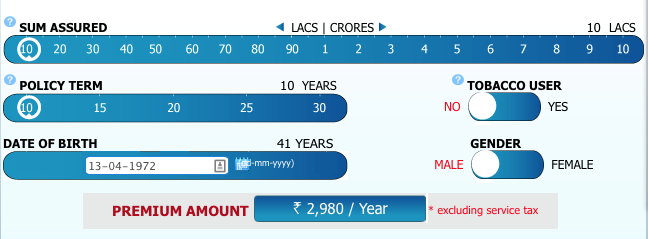

Generally speaking you should be insured for 10x to 12x your annual income + any liabilities (loans) you have.

So if your annual income is Rs.10 lakhs and you don’t have any home loan, get a term insurance for minimum 1 crore.

If you have a home loan of Rs.50 lakhs, up your term insurance to Rs.1.5 crores.

Which Term Insurance to choose?

There are many providers to choose from and it is easy to buy a term insurance online by spending less than 30 mins. All Insurance Providers are regulated by the IRDA, so you can choose any provider. So it makes sense to choose the provider who gives the lowest price and has the highest settlement ratio.

But you should make sure that you fill in your insurance form by yourself and fill it in truthfully. The premium you pay depends on your health conditions (smoker/diabetes/heart condition/etc). If you fill it in with wrong details, there will complications when the policy is claimed. And the only time the policy is going to get claimed is when you are not alive – leading to unnecessary complications for your near and dear.

So always fill in the form properly and get the mandatory medical test to avoid complications.

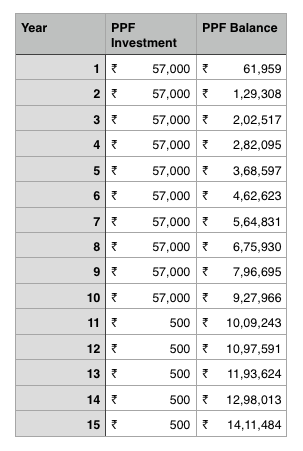

Now that you have covered your dependents for cases when you might not be alive and also gotten tax deductions for the premium paid, next is to invest the remaining money for your future and also get tax deductions for that.

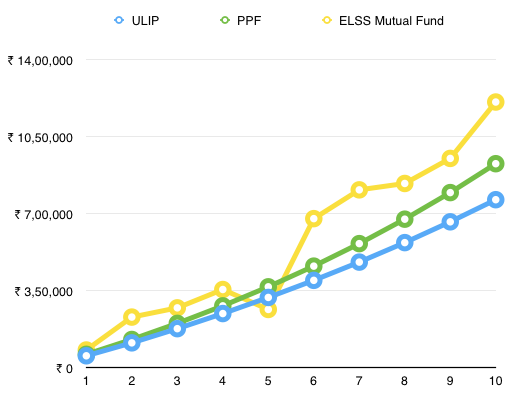

The next article is about my most preferred tax efficient investing method – ELSS funds. Do give me your email address below and I will send it to you as soon as I publish.