Note: This article was originally published in April 2014 and has been updated with the latest numbers as of 2019.

Note: This article was originally published in April 2014 and has been updated with the latest numbers as of 2019.

If I had the technology to send a message back in time, I would tell my father in 1980 to “Use Rs.10,000 to buy 100 shares of Wipro as a one-time investment and never sell it for the next 40 years.” If he had done that his investment would now be worth about Rs.1200 crores. Yes, you read that right. Crores, not thousands or lakhs.

This is one of the common examples given when people come into investing in shares in India. Almost every Indian blog about investing in stock markets gives this example and I also post this here as requested by a reader. A lot of people think that it is a lie and don’t believe it, but it is possible and there are numbers to prove it.

Rs.10,000 to Rs.1200 Crores

Let’s just assume that you bought 100 shares of Wipro each at a face value of Rs.100 in the year 1980. Total investment: Rs.10,000. You don’t touch it at all, no profit booking or buying more shares. Occasionally companies provide benefits to its shareholders by way of corporate actions. They could provide bonus shares for shares that you hold, they could do a stock split where a high face value share would be broken down into smaller face value shares but the number of shares increases proportionately, etc.

Wipro has done various such bonuses and stock splits in its history of 1980-2017. Lets now see the different corporate actions and how the number of stocks would’ve grown.

| Year | Action | Number of Shares | Face Value |

|---|---|---|---|

| 1980 | Initial Investment | 100 | Rs. 100 |

| 1981 | 1:1 Bonus | 200 | Rs. 100 |

| 1985 | 1:1 Bonus | 400 | Rs. 100 |

| 1986 | Stock split to FV Rs.10 | 4,000 | Rs. 10 |

| 1987 | 1:1 Bonus | 8,000 | Rs. 10 |

| 1989 | 1:1 Bonus | 16,000 | Rs. 10 |

| 1992 | 1:1 Bonus | 32,000 | Rs. 10 |

| 1995 | 1:1 Bonus | 64,000 | Rs. 10 |

| 1997 | 2:1 Bonus | 1,92,000 | Rs. 10 |

| 1999 | Stock split to FV Rs.2 | 9,60,000 | Rs. 2 |

| 2004 | 2:1 Bonus | 28,80,000 | Rs. 2 |

| 2005 | 1:1 Bonus | 57,60,000 | Rs. 2 |

| 2010 | 2:3 Bonus | 96,00,000 | Rs. 2 |

| 2017 | 1:1 Bonus | 1,92,00,000 | Rs. 2 |

| 2019 | 1:3 Bonus | 2,56,00,000 | Rs. 2 |

After the year 2019, there were no more bonuses or stock splits. But with just that initial investment of Rs.10,000 (100 shares) you now would end up with 2,56,00,000 shares of the company because of all the stock splits and bonus shares. The current stock price of Wipro is about Rs.469 per share, as of 18 April 2021.

Rs.469 × 2,56,00,000 = Rs.1200,64,00,000 or about Rs.1200 crores. That is a CAGR (Compound Annual Growth Rate) of more than 40%. Does any of your bank FD give you a 40% annual interest rate? It was all possible because of the free shares that the company gave to its shareholders as an incentive for investing in their company. If you immediately needed to liquidate this entire holding today (urgent need for >Rs.1200 crores?), you can do it and you would have to pay a very small long term capital gains tax on it (which was recently introduced).

How about an additional yearly payout of Rs.2.56 crores?

If you thought that Rs.741 crores out of a meager investment of Rs.10,000 were unbelievable, here comes another shocker. Every year the company announces dividends from its operating profits for its shareholders. As a shareholder, you would also get this benefit for how many ever stocks you hold.

For example, the past 4 years, the company announced Re.1 per share as dividends. So you get back Rs.2.56 crores just for holding the shares. Until recently dividends were also not taxed. But now any aggregate dividend above Rs.10 lakhs is taxed at 10%.

For a comparison, just calculate your (or your dad’s) current salary per annum and imagine getting a crore every year as additional income. How does this Rs.10000 investment compare to all the other money invested in other products like real estate or gold? No other investment would’ve given you such returns and dividends every year. If only my dad had the surplus money to invest in this.

Has anybody really done this? Can I go buy Wipro now?

As the saying goes “hindsight is 20/20”, we can calculate all this only after the company has grown from selling vegetable oils, soaps to becoming an IT major. Had everyone known that this cooking oil company would give such returns in 1980, everyone would have invested in this and become billionaires. Also, the shares wouldn’t have been listed on any exchange in 1980 and you would have had to invest privately into the company. Buying Wipro now wouldn’t give you the same returns as the company is already grown to such proportions and such a large-cap stock giving multi-fold returns is very hard.

How can I get returns like this?

There have been numerous such companies that have given great returns to investors, like Reliance, Titan, Dr. Reddy Labs, etc. No one can predict which company would grow to such a huge level before 30 years. Remember, for every story like Wipro, there are thousands of companies that have eroded investors’ wealth and become penny stocks. Investing in equities alone isn’t enough, investing in the right company at the right time is even more important.

Even if someone invested in the best company in the world, its basic human psychology to book profits when the stock prices increase so many folds. Some investors don’t feel comfortable even for a 50% increase in their investment. No one would have the patience to hold such a stock when he sees how volatile the market is in the short-term.

If you really want such phenomenal returns, you would have to do a lot of fundamental research, do your due diligence on the company and invest in it when it’s in the early stages. Most important of all is, staying invested in the company for the really long-term to reap the entire benefits.

Update:

- I have written another article that has 6 stocks that have been multi-baggers – and how I got a 23x return on my investment on one of those stocks.

- Read this if you want to understand about Bonus vs stock split and other corporate actions.

When a company gives a bonus stock to it’s shareholders, it allots extra stocks to them. They are a gift to the shareholders for trusting and investing in the company. The bonus shares are issued out of the cash reserves of the company. You basically get free shares or equity against shares that you currently hold.

When a company gives a bonus stock to it’s shareholders, it allots extra stocks to them. They are a gift to the shareholders for trusting and investing in the company. The bonus shares are issued out of the cash reserves of the company. You basically get free shares or equity against shares that you currently hold. Stock Split literally means what you think it means. The stock is actually split. When a stock split happens, the number of shares held increases, the value of your investment remains the same. The only thing that gets split is the face value.

Stock Split literally means what you think it means. The stock is actually split. When a stock split happens, the number of shares held increases, the value of your investment remains the same. The only thing that gets split is the face value. Usually the price is slightly higher than the current market price so that it provides an incentive for the shareholders to use the buyback opportunity.

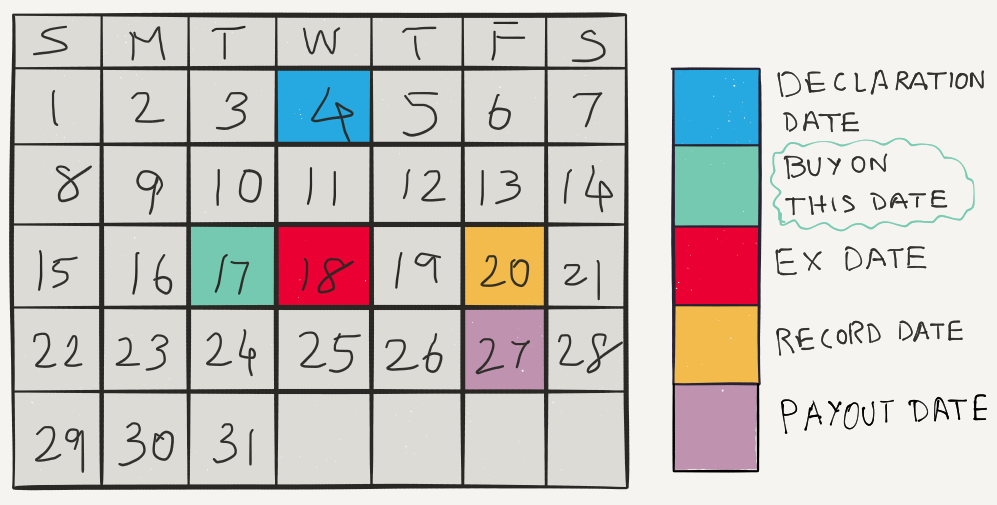

Usually the price is slightly higher than the current market price so that it provides an incentive for the shareholders to use the buyback opportunity. These are a portion of the profits that the company gives to it’s shareholders. Many companies typically give one or more dividends per year. They are announced as a percentage of the face value of each stock. So if a stock’s face value is Rs. 10 and the company announces a dividend of 100%, you will get Rs.10 as dividend for each stock you hold.

These are a portion of the profits that the company gives to it’s shareholders. Many companies typically give one or more dividends per year. They are announced as a percentage of the face value of each stock. So if a stock’s face value is Rs. 10 and the company announces a dividend of 100%, you will get Rs.10 as dividend for each stock you hold.