This is part 3 of the series about Tax Savings and I will be explaining in detail about one of my favourite tax savings investment – ELSS Funds. Click here for the previous parts about tax slabs and Life Insurance.

ELSS Funds

ELSS stands for Equity Linked Savings Scheme and it is just a fancy name for a equity mutual fund which has a lock-in period of 3 years and investments under which you can claim tax savings under 80C.

Now that is a lot to take in that previous line – lets break it down.

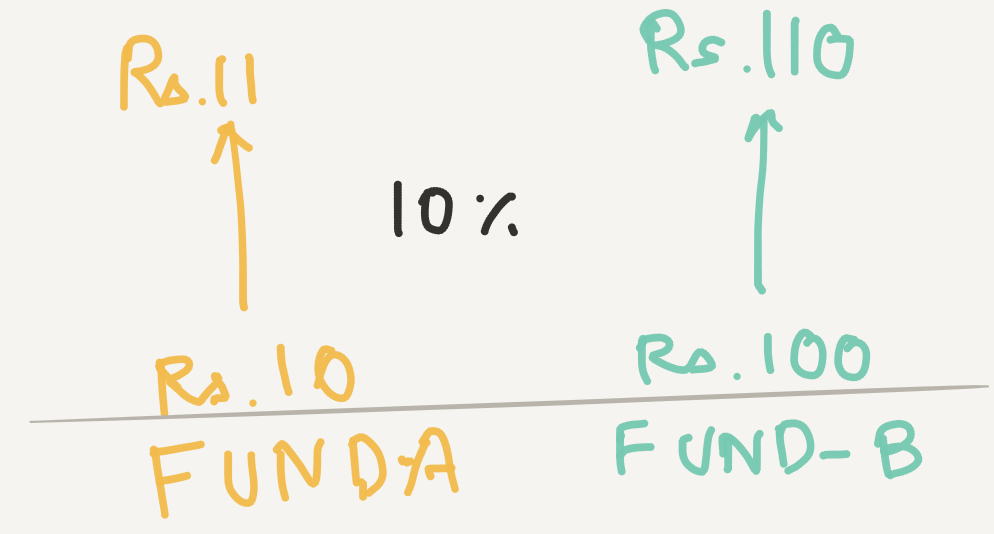

Equity Mutual Fund: You invest your money along with thousands of others to collect a huge corpus of fund. There is a dedicated professional who handles all your money and invests it in different stocks/bonds. He is called the Fund Manager. For this he charges a small percentage per year as fund management fees (also called expense ratio). Equity Mutual Funds are the most efficient investments which can also beat inflation.

Lock-In period: Any normal equity fund doesn’t have any lock-in period. Which means you can put your money today and choose to take it out in a few days. There might be some charge, but your money isn’t locked in.

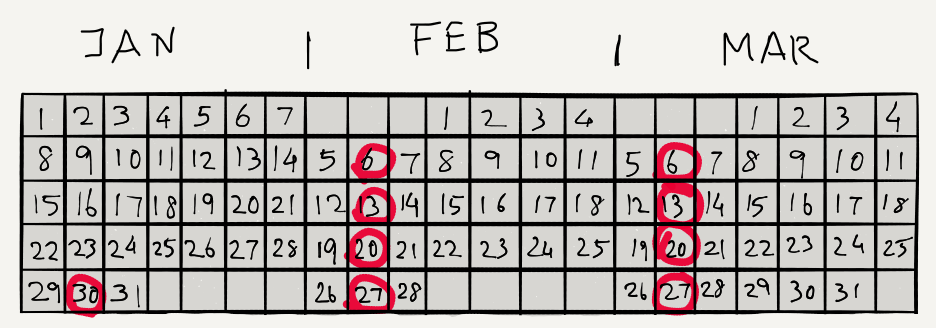

But ELSS mutual funds have a lock-in period of 3 years. If you invest your money on Jan 1 of 2017, you will be able to take it out only on Jan 2 of 2020. Having a lock-in makes sure that you are invested for the long time which is very important for equity funds.

Usually all tax savings investments have a lock-in period. ELSS funds has the shorted lock-in period of 3 years.

Tax Savings under 80C: Investment made in ELSS funds are eligible for tax deductions under section 80C. You can invest any amount in ELSS funds, but a maximum of Rs.1.5 lakhs will be eligible for 80C deduction.

So how does one invest in ELSS funds?

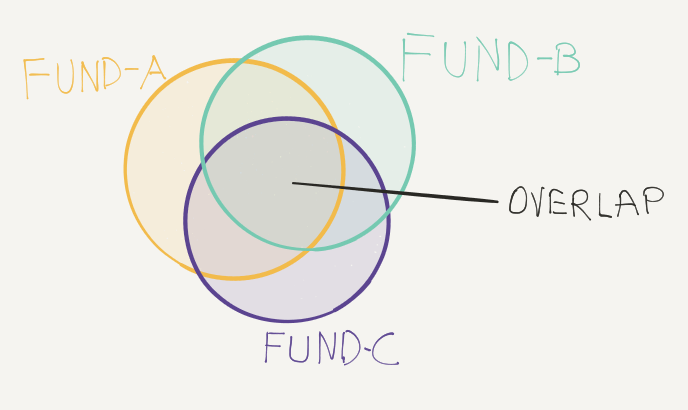

There are numerous fund houses which has a tax saver or ELSS fund. You have to first identify a fund which is good. Since your money is locked in for 3 years, choosing a good fund is important.

There are numerous websites which list mutual funds and one website that I use is Value Research Online. Go there and select all ELSS funds available and go through each of them. See how well it has performed over the past years.

- Has the fund manager consistently beaten the benchmark?

- How many years has the fund manager been managing the fund?

- Is the expense ratio small enough?

- You can also look at the portfolio of the fund to see if the companies it has invested in are diverse enough and well performing companies.

Always do SIP

Once you decide which fund to invest in (pick only one) start an SIP on the fund. Most mutual funds allow investing directly online through their website. If not, you would have to download and fill up the form and write out a cheque for the amount and send it to one of the investor centres.

It is important to start a monthly SIP so that your investment isn’t affected by the volatility of the market. Whether the market is up or down, you keep investing in it and let the investment take its own time to bear fruits.

Though ELSS are my favourite of the tax savings investments, it isn’t the only place where I invest. There are also other instruments which would be a good fit for your risk taking abilities. In the next part I will explain about those.

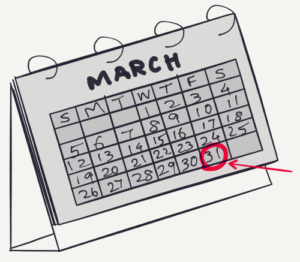

If you are a salaried employee, the next 1 month is when your company’s HR/Payroll department keeps bugging you for your tax savings. And many employees haven’t done any investments for tax savings for this year or haven’t completely maxed out your 80C. If you also belong to that camp, there would be some colleague or friend who would try to sell you some LIC policy or a ULIP policy. But you know that you handling your insurance and investment yourself will lead to much better returns than buying a ULIP at the last moment.

If you are a salaried employee, the next 1 month is when your company’s HR/Payroll department keeps bugging you for your tax savings. And many employees haven’t done any investments for tax savings for this year or haven’t completely maxed out your 80C. If you also belong to that camp, there would be some colleague or friend who would try to sell you some LIC policy or a ULIP policy. But you know that you handling your insurance and investment yourself will lead to much better returns than buying a ULIP at the last moment.