Prices of any asset doesn’t always go up. Whenever the prices rally, there is bound to be a correction soon. A correction is when the prices stop going up and begin going down. It is usually a good thing as it helps adjust the price as the sudden increase has overvalued the stock. This holds true for any asset class you may choose – be it stocks, bonds, gold or even real estate. Lot of people think, well gold and real estate prices never go down, it always goes up. But, they were also affected badly when recently gold prices dropped last year.

It is the same case for real estate, as the prices have stagnated and have stopped going up and the inventories of various builders are growing. But you may ask, the prices haven’t gone down, right? Actually you may not realise it, but the prices have corrected – not in absolute value, but in terms of time value.

Assets can correct in two ways:

- Price Correction

- Time Correction

Price Correction

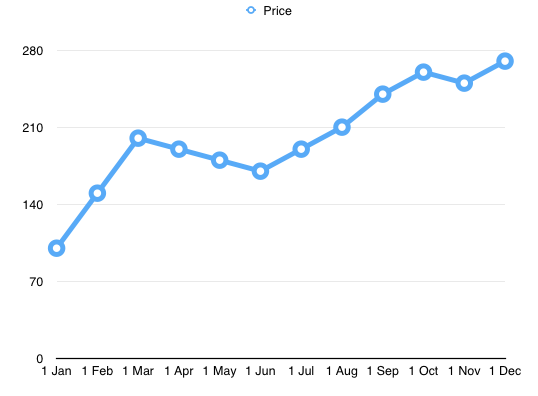

This is simple to understand. When the price of an asset rallies up a lot and then comes down by at least 10%, it’s value has gone down. Example, say a stock has grown from 100 to 200 in about 3 months, which is a 100% increase, and the prices correct back to a lower level (say Rs.170) before it can continue the rally.

This is what we call as price correction. This is important in any healthy stock or market. If the prices keeps on increasing without even a little correction, it is mostly manipulated by operators and is very risky, it might be leading to a bubble. Occasional corrections are OK and nothing to worry about. Lot of people panic when they see the prices correcting to even a very low 3%-5%. That is nothing to worry about as long as your view of the company hasn’t changed and you believe the stock will go back up.

Time Correction

This is a type of correction that many people wouldn’t think about. It is also popularly known as consolidation in technical analysis. Lets say a stock price increases from 100 to 200 in 3 months (same 100% increase), but for the next 3 months it doesn’t go anywhere and it just oscillates between 190-210, it is called time correction. Even though an investor who got in at Rs.100 is happy that he doubled his investment in 6 months, I would say he wasted 3 months.

He as a short-term trader, is losing money by holding on to this stock. This is what is called time correction. Many stocks consolidate after a huge rally to take a breather. After the consolidation, the prices can either continue the rally or can even go down. This is a risky time to enter into the stock.

Which type of correction is popular?

Both types are corrections are possible in all asset classes. Even high-quality blue-chip stocks like SBI, Reliance, HDFC, L&T, etc., correct or consolidate after a rally. So is gold, the price of gold kept rising for a long time and every one said, “No one can lose money investing in gold”. But the prices did fall and many investors in gold were hurt badly.

Real estates correction are much harder to see, because there is no officially published market price for a piece of land. But the prices can decrease, but realty is more prone to time correction. A price of a land which nearly doubled in 2 years would stay at the same rate for even more than 4 years. Since most home owners don’t sell their apartment within a few years, they don’t realise that the returns they got is almost the same as they getting from a FD.

Remember this next time you invest in an asset and the price has not moved at all for a very long time. You are losing money by holding it. Instead its best to book your profits and switch it over to an asset which has a much higher chance of a rally. Also just because an asset has corrected doesn’t mean it needs to be sold. Holding onto it may give you even better returns.