Dividends are payments that a company pays to its shareholder from the profits it had earned from running the business. When a company earns profits, they have the choice to either reinvest that money into the business for expansion, acquisition of other companies, hiring more employees, etc. There also can divide the profits and give it back to the investors, as a token of appreciation for believing in the company and investing in it.

Most companies retain a part of the profit for investing back into the business and pay the remaining profits as dividends. This is done so that there is enough cash for running the daily business and also helps earning the goodwill of the investors. Dividends are paid as cash and mostly credited into your bank account on a specific date (or they may mail a cheque if you are old-fashioned).

Companies declare dividend as an amount per share. Example, if you owned 1 share of SBI, and the company declares Rs.5 per share as dividend, you would get Rs.5 credited in your account. If you owned 100 shares, 100 shares * Rs.5 = Rs. 500 will be your dividend.

Now you may say “Neat. So if I know on which date a company is going to pay dividends, I can buy as much stocks as I can before that date and after I get the dividend, sell all the stocks. Easy way to make profits right?” Yeah right, thats how people earn money in stock markets. No you dumbo. If it were that easy why are we still going for jobs and running businesses. Everyone can buy and sell dividends before and after the dividends are paid.

To understand this, you need to understand a few “dates”:

- Announcement date

- Ex-dividend date

- Record Date

Announcement Date

This is the date that the company board of directors announce that they want to declare a specific amount per share as dividend. The announcement is done to the exchanges and this date is simple to understand.

For example, lets assume a company announces dividends on 21 April, 2014. During the announcement, you need to find out two other information (other than the amount being paid) – Ex-Dividend Date and Record Date. In our example lets assume that the company announces Ex-Dividend Date as 1 May, 2014 and Record Date as 2 May, 2014.

T+2 Settlement

When you buy a stock on the exchange, it doesn’t immediately gets credited into you DeMat account the next second. It takes some time for the seller to give the stock to his broker and then to your broker and then to your DeMat account – this is called settlement. In India we follow what is called the T+2 settlement. Meaning: it takes 2 days from the date of the transaction for the stock to come to your account. Transaction Date + 2 days.

So if you bought a stock on 21st of April, it would be credited to your DeMat account on 23rd of April. After 23rd of April, your name is now in the record books of the company and you are one of the proud shareholder.

Record Date

Now Record date is the date the company takes out it’s record book and makes a list of all it’s shareholders. Actually since everything is now in electronic format, it isn’t an actual book, the company asks the depository (who holds your DeMat Account) for a list of all shareholders on the Record Date. Now after it gets the record date, all it has to do is, distribute the dividend per share to all the shareholders and everyone will be happy. In our Example, 2nd May is the record date – so if your name is in the records of the company on 2nd May, you will get the dividend.

Ex-Dividend Date

Now you may ask, what is the Ex-Dividend Date. Lets say the stock is trading at Rs.100 per share and the company announces a dividend of Rs.5 per share. Now from where does the company pay the dividend? From the profits of the company. The stock price is a calculation of the companies assets, liabilities and also any profits it earned each quarter. So if part of the profit is taken out as dividend, the stock price also will be adjusted appropriately. So the stock price will become Rs.95 (actually even a bit less because of taxes, but we will see that later).

Now there must be a date when the stock price is adjusted from Rs.100 to Rs.95 – from cum-dividend to ex-dividend. Before the ex-dividend date, the stock price includes the entire profit and dividends. On the ex-dividend date, the dividend is taken out of the company accounts and the stock price also reflects this change. This is also announced by the company. See, your master plan of buying before dividend and selling after dividend to profit the money is gone.

When should you buy to get dividends?

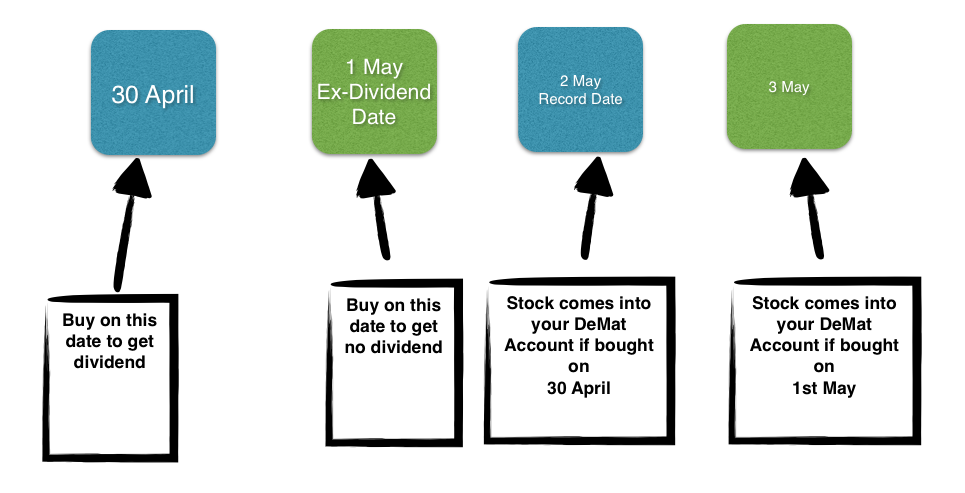

But you are not finished yet. You need to make sure you bought the stock on the correct date to get the dividend. If our example 1st May is the Ex-Dividend date. So you much buy the stock before date (cum-dividend) to get your dividend. Lets say you bought the stock on 30 April and based on the T+2 settlement calculation, the stock would be in your DeMat account on 2nd May. Your name would be listed as a shareholder on 2nd May and you would get the dividend.

Lets imagine you missed the date and bought the stock on 1st May. Your DeMat account would be credited on 3rd May only and you are not eligible for dividends. Does that mean you lost money? No. Remember that 1st May is Ex-Dividend date, so you bought the stock at Rs.95 instead of Rs.100. So you are paying less for the stock than what others paid on 30th April. The dividend of Rs.5 is already in your account as you didn’t spend it at all.

Initially this concept is a bit tough to wrap your mind, but if you read it again, you can easily understand it.

As long as you buy the stock before the Ex-Dividend date, you are eligible for dividends. Anything on or after Ex-Dividend, you won’t get dividends.

Thanks for sharing and educating novice investors like me in a simple manner. Asghar