The first cognitive bias we will see in behavioural finance is “Anchoring” or also called “Focussing”. It refers to the common tendency to rely too much on the first information we hear whenever we make any decisions. Imagine you want to sell your car and a mechanic comes to your home and looks at it.

Mechanic: Sir, I can give Rs. 1 lakh for it.

You: What? No can do. I bought it for Rs.4 lakhs and it is just 3 years old. Rs.1 Lakh is too low.

Mechanic: There is already an history of accident and I need to spend at least Rs.50,000 more on repairs.

You: Oh come on. Can’t you at least give Rs.1.25 lakhs?

Mechanic: Ok. Deal.

Now what happened here? The mechanic started off by giving the number first and you were “anchored” to that price. If he didn’t start at a number, you could have gotten at least 1.5 to 1.75 lakhs for the car. Since he stated the number first, your mind immediately fixed at that and couldn’t go more than 25% of that number.

Even though its an imaginary conversation, you would have had a similar experience in various situations – salary negotiations, bargaining something you want to buy, getting a loan from your bank, etc.

This anchoring effect has been proven by researchers in various situations. Many times they were surprised with the results, because the anchored number had nothing to do with price – e.g.: last 2 digits of a SSN (Social Security Number), random numbers from 1-100, etc. Any number you see will affect the price you are willing to give for a product. But did you know that this effect is also seen in the world of stock market investing or trading? Yes, you as an investor will lose more than you could gain because of this effect.

Anchoring Bias in Investing/Trading

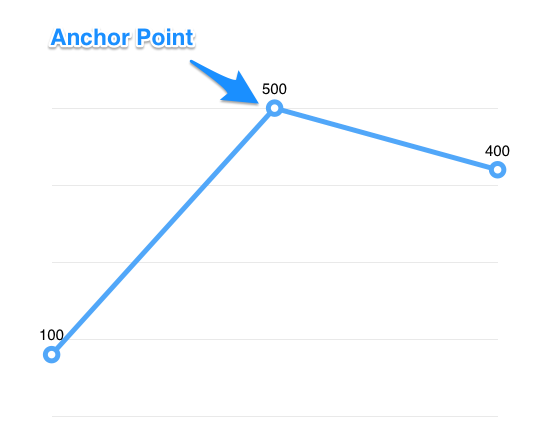

Lets say you bought 100 numbers of a share at Rs.100 (Investment of Rs.10,000). And the stock had a nice bull run and after many years it made a high of Rs.500 per share. Nice profit of Rs.40,000. But since stocks are volatile in nature, it too will come down. Lets say today the stock is priced at Rs.400 per share. Would you sell the stock and book profits?

If you said “No way. Do you want me to sell at a loss? This recent down trend is temporary. It will go back up to Rs.500 and even more.”, you are a victim of the anchoring bias. You saw the high of Rs.500 per share and the thought of selling at Rs.400 meant it is a loss for you. Even though you are sitting at a nice profit of Rs.300 per share, the Rs.100 you missed is what you remember.

This can work the other way around too. Lets say you bought a stock at Rs.500 and the stock falls continuously and settles at Rs.100. Most amateur investors will immediately look at this as an averaging opportunity and buy more of the stock. Their reasoning is compared to the Rs.500 per share, Rs.100 is a bargain price. They are anchored to the Rs.500 price.

They won’t research on what made so many people to sell the stock. There could be a fundamental problem with the company like loss of revenue, lot of debt, heavy competition, decreasing customers or order books, etc. If that were the case, there is no use in averaging the stock and it would only lead to more losses. There have been numerous examples like Suzlon, Educomp, KingFisher, etc., where numerous investors have lost lot of money.

How to avoid Anchoring Bias?

The only way to avoid this effect is to think rationally and critically before making any decision. In order to think properly, you would need as much of objective information as possible about the situation – be it negotiating your salary, your car price or investing.

If you are negotiating your salary, make sure to get lot of information about the role you are filling in.

If you are negotiating a loan or buying a car, just forget the first number they other guy says try to think objectively and come to a number you are comfortable

If you are investing, don’t just go with the prices of stocks, but learn to do fundamental analysis on the company and analyse why there has been such a heavy loss. Don’t jump in and buy stocks just because it looks cheap.

A few minutes of critical thinking wouldn’t cost you too much – in fact you can gain more than you lose if you can remember the anchoring bias. Next time you are negotiating something, try to remember who made the offer and how much you actually expected to get before hearing that offer. Read more from Wikipedia.