In my last article I explained everything about credit cards and how easy it is to fall into the debt trap. If you haven’t read it, go and read it first. Two basic things should be obvious from that article:

- Interest Rates on credit card debt is one of the highest ever for an individual

- Paying just the minimum balance every month will take you years to clear off your debt and you lose a lot of money by paying interest.

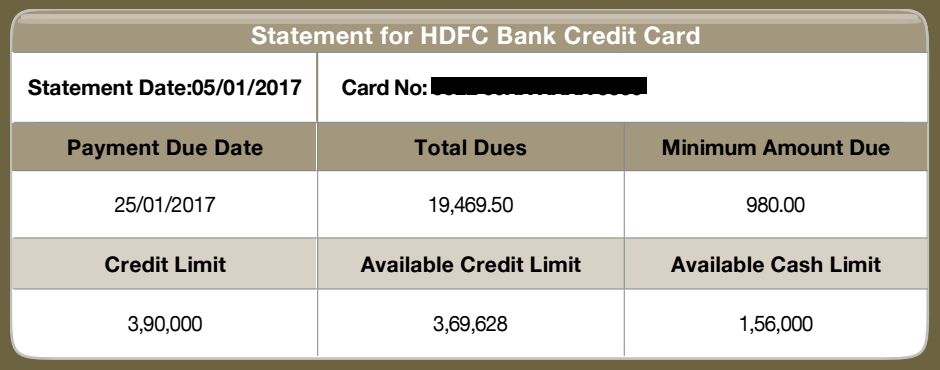

We will take the same example of a credit card having an outstanding balance of Rs.1,00,000 and 3.25% interest rate per month. Lets also assume that your salary is not enough to repay the entire debt in a single month after all the expenses.

So you were paying only the minimum balance of Rs.5000 per month. But you saw that it will take 33 months to repay the entire debt. What if you wanted to repay it sooner? For that to happen there are two factors that play a role here:

- The bank should reduce your interest rate (Yah! like that is going to happen so easily)

- You pay slightly more than the minimum balance every month. With a little bit of proper budgeting, this is easier to manage and is within our control. Lets take 3 examples and see how each works out.

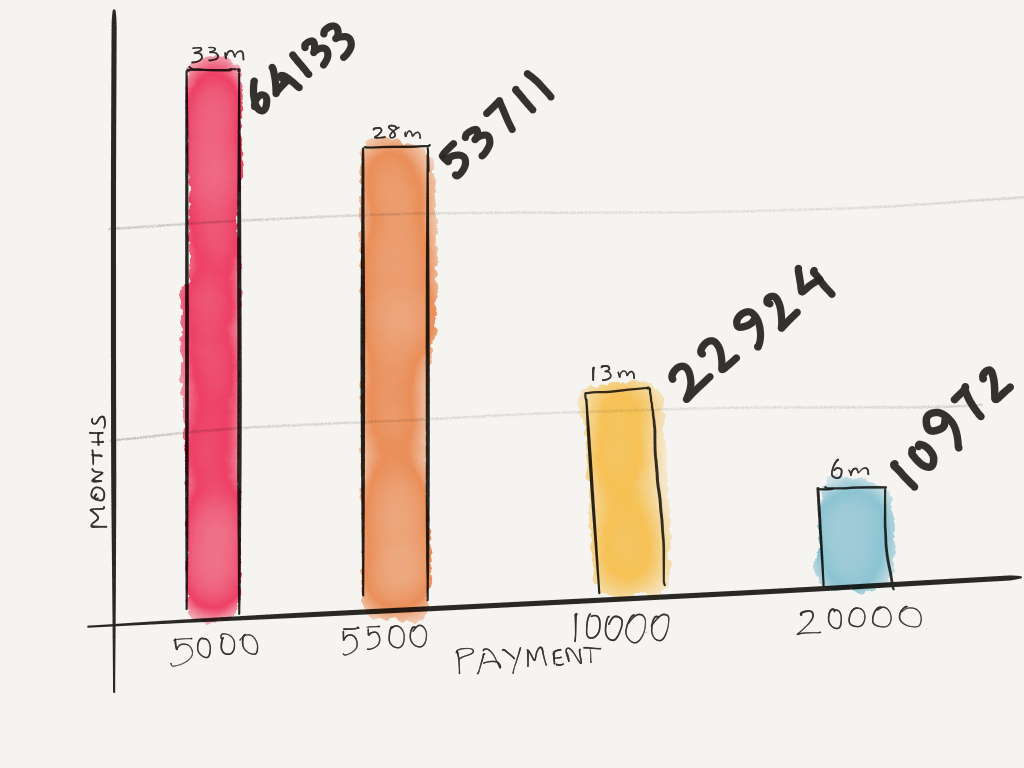

Lets take 4 possible scenarios:

- You are only able to pay the minimum balance of Rs.5000 per month.

- You are able to pay 10% more than the minimum balance. So instead of paying Rs.5000, you can pay Rs.5500 per month.

- You are able to control some of your expenses and can pay back Rs.10,000 per month. Double of your minimum balance.

- You got a raise and also cut down on your expenses. Now you are able to pay back Rs.20,000 per month.

You can plug in these numbers in one of the numerous calculators online or can check out this graph that I drew with the calculations already done.

| Option | Monthly Payment | Num of Months | Interest paid |

|---|---|---|---|

| A | 5000 | 33 | Rs.64,133 |

| B | 5500 | 28 | Rs.53,711 |

| C | 10000 | 13 | Rs.22,924 |

| D | 20000 | 6 | Rs.10,972 |

This shows that even a small 10% increase in the monthly payments helps a lot by saving you 5 months and more than Rs.10000 as interest paid to the bank. If you have credit card debt make sure that you are putting in as much money as you can into your monthly payments.

What about very large outstanding balances?

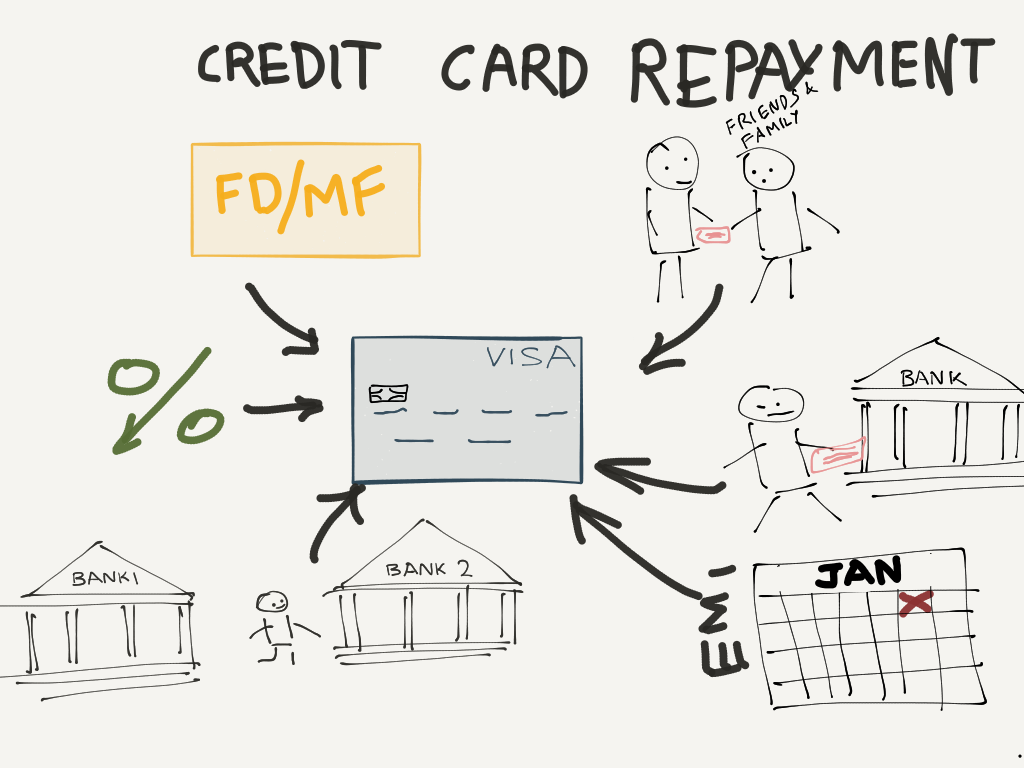

There are numerous people who got too deep into the credit card debt trap, that it would take them many years to finish repaying their bill. What to do in those cases? Here are 7 ways that you can get out of your credit card debt almost instantly.

1) Break your savings/investments

If you have money lying around in your savings accounts or fixed deposits, break them and use that money to repay your credit card bill. Your fixed deposits might earn you 8% per annum. But remember your credit cards are making you lose 39-42% per annum. You will definitely be profitable by paying off your debt first than not breaking your fixed deposits.

Also remember it doesn’t have to be just FDs, but it could also be money that you have invested in mutual funds or bonds, etc. As long as you keep losing money servicing your debts, any investments would give you a net negative return on your networth.

2) Take a loan from friends/family

If you have a good relationship with friends or family, you can take a small loan from them to repay the bill first. Most friends/close family would give you money for zero or very low interest rates. Even if you agree to pay a bank FD rate to them, they would be profitable and you also would get a loan at much lower rates than banks.Win-Win situation to both parties. Also, it is easier to convince a close friend or family member.

3) Take a personal loan from your bank

Go to the bank with whom you have a good relationship and talk to the manager to get a personal loan for the amount you have to repay. The interest rates for personal loans are much higher than what you can get a friend to agree to, but it is definitely lower than a credit card debt. Personal loans are at a rate of about 16%-20% per annum and you end up paying half the interest rate than a credit card.

If your credit report is bad and your CIBIL score is too low, you can go for a secured loan. You have to give a collateral to the bank and get a loan. You can also try gold loans or top-up loans if you have a home loan already.

4) Convert Credit Card debt to EMI

Most banks gives you the option to convert Credit Card debt into EMIs which has a much lower rate than the APR – usually 13%-16%. You can also chose to convert it to an EMI immediately after purchase and you also get different repayment tenures like 3/6/9/12/24 months.

5) Balance Transfer to a different Card provider

Lot of banks provide a balance transfer facility to get new customers. All you have to do it become a new customer with a bank and the new bank will pay off your old credit card fees and will transfer the outstanding balance to your new card account. And as an incentive for you to join a new bank, they give interest free period of few months and very low interest rate for initial 6 months.

Eg: SBI offers a 0% interest for 2 months or a 1.7% interest/month for 6 months. Depending upon your balance to be paid and your repaying capacity you can choose whichever plan suits you.

6) Negotiate a lower interest rate

Remember I said lowering the interest rate means you get to pay back sooner? You can go to your bank and explain your financial situation to the manager and try to negotiate a lower interest rate. You have to convince them that you are willing to pay and intent to do it fully within a few months once your financial situation gets better, you can shave off a few percentage points off the interest rate. It is a long shot, but you can try it.

7) Credit Card Settlement

If all else fails and you think you can never completely pay off the entire balance, you can go in for a settlement. You have to go to your bank and negotiate a settlement amount (which is lesser than the outstanding amount). Once you pay off the settlement amount, your balances are cleared and you are free to go. Except this involves the bank reporting to CIBIL about the settlement and it will severely affect your credit score. Always use this as a last resort.

Be warned, all these are solutions only if you are unable to repay the balance easily. These solutions shouldn’t give you some sort of safety net to get into the debt trap.

3 Golden Rules to using a credit card

Always remember these 3 rules when using a credit card:

- Never spend more than you can afford.

- Pay your credit card bill at least 3 days before due date. Better enable auto debit facility from your savings account so you don’t have to remember it.

- Never lose money by paying unwanted interest rate to the bank. Remember no one has ever become rich by losing money.