In the last article, you learnt the difference between bonuses, stock splits, rights issue and buybacks. But many would be confused on the different dates related to these corporate events. And on what date should one buy to get the benefits?

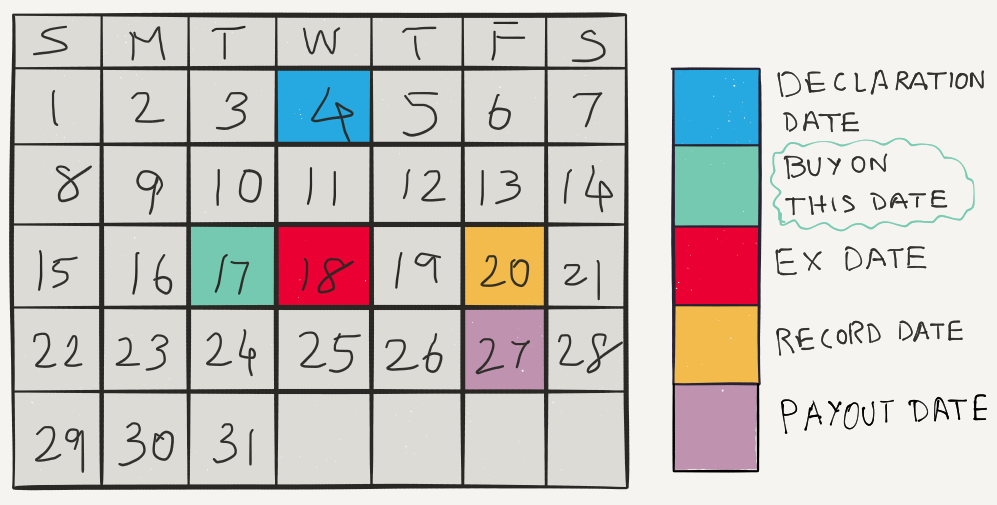

There are usually 4 dates which are important related to any corporate action. Lets see an example with dividends. The same would apply for others too.

- Dividend Declaration Date

- Record Date

- Ex Dividend Date

- Dividend Payout Date

Dividend Declaration Date

This is the date the Board of Directors meet for the Annual General Meeting (AGM) and decide whether or not to give dividends. Though the agenda of the AGM (including the dividend) is set before itself the actual voting happen during the AGM. Once the company’s board approves the dividend issue, they decide something called as Record Date.

Record Date

Shares of companies trade every day in the market and it is hard to identify who gets a dividend and who doesn’t get a dividend. This Record Date helps the company to fix the date when to get the list of all shareholders who are eligible for dividends.

As soon as you get a share of a company, your name is recorded on the register for the company as a shareholder. If on the record date your name is present in the register, you are eligible for dividend. Usually there is a decent time difference between the dividend declaration date and record date – leaving time for investors to buy stocks for dividends.

Ex Dividend Date

Ex Dividend date is the date by which you should buy the shares. In India, stocks settlement is on T+2 basis. So if you bought a stock today, you will get the stocks in your demat account after 2 working days from day. That is the date, you name also gets recorded in the company’s register.

So if your name needs to be on the register before the Record Date, you should have bought the stock 2 working days before the Record Date. So Ex Dividend Date is always 2 days before the Record Date. If you are buying a stock for the dividend make sure to buy it before the ex dividend date. On Ex Dividend date the stock price quotes at minus the dividend per share.

So if a stock is quoting at Rs.100 on the day before Ex Dividend Date and the company declared a Rs.10 dividend per share, on ex date, the price will be subtracted by Rs.10.

This makes sure that if you bought a share on ex date or later, you are not paying extra money for the dividend that you won’t be getting. Since that money is payed out to the shareholders, and you will not be in the register by the record date, you don’t have to pay a premium.

Dividend Payout Date

This is the date on which the company pays out the dividend. This comes in at least a week or two after the record date and the payout is in the form of direct account transfer or cheques.

The same dates can be applied to other corporate actions like bonus shares or stock splits. Instead of a bonus payout or stock split payout, your demat account would automatically be credited with the new stock.

This just shows that even if you missed your chance to buy a company’s shares in time for the dividend/bonus/split, you are not at a loss. As long as you believe in the company for the long run, you can invest in it and not worry about dividends/bonus.

When a company gives a bonus stock to it’s shareholders, it allots extra stocks to them. They are a gift to the shareholders for trusting and investing in the company. The bonus shares are issued out of the cash reserves of the company. You basically get free shares or equity against shares that you currently hold.

When a company gives a bonus stock to it’s shareholders, it allots extra stocks to them. They are a gift to the shareholders for trusting and investing in the company. The bonus shares are issued out of the cash reserves of the company. You basically get free shares or equity against shares that you currently hold. Stock Split literally means what you think it means. The stock is actually split. When a stock split happens, the number of shares held increases, the value of your investment remains the same. The only thing that gets split is the face value.

Stock Split literally means what you think it means. The stock is actually split. When a stock split happens, the number of shares held increases, the value of your investment remains the same. The only thing that gets split is the face value. Usually the price is slightly higher than the current market price so that it provides an incentive for the shareholders to use the buyback opportunity.

Usually the price is slightly higher than the current market price so that it provides an incentive for the shareholders to use the buyback opportunity. These are a portion of the profits that the company gives to it’s shareholders. Many companies typically give one or more dividends per year. They are announced as a percentage of the face value of each stock. So if a stock’s face value is Rs. 10 and the company announces a dividend of 100%, you will get Rs.10 as dividend for each stock you hold.

These are a portion of the profits that the company gives to it’s shareholders. Many companies typically give one or more dividends per year. They are announced as a percentage of the face value of each stock. So if a stock’s face value is Rs. 10 and the company announces a dividend of 100%, you will get Rs.10 as dividend for each stock you hold.