Lot of people get misguided into buying Unit Linked Insurance Policy (ULIPs) by insurance agents. I happened to read the application form of a person who recently applied for HDFC SL ProGrowth Flexi Plan. Reading that, I wondered if I could come up with a better plan than this ULIP plan – with better returns and better insurance cover.

First let me give a brief introduction about the person. He is a 41-year-old male living a few streets down from my home. He has his own fruits shop in the Koyembedu Wholesale Market Complex (the largest in Asia). He is a healthy person, married and has a 7-year-old kid. His income is about Rs. 800,000 per year everything from his business.

Unit Linked Insurance Policy

His policy is for 10 years with a cover of Rs. 600,000 with his kid as the nominee. For this he pays a monthly premium of Rs. 5000 (Rs. 60000 per year). End of 10 years he would have paid Rs. 600,000 as his premium with a life coverage of just Rs. 600,000.

Since this is a unit linked policy, if the market performs better, his fund value and his investment also increases. But by how much? The insurance companies need to show a projected statement of premium, fund value, death benefits, etc., for 4% and 8% returns. If he dies anytime when his policy is valid, his son would minimum Rs.600,000. No problem with that.

Lets look for the most likely scenario – he lives through the term of the insurance and after 10 years gets back his investment. At 4% return he would get back Rs. 623,135 and at 8% rate he would get back Rs. 764,405 after 10 years. Lets take the higher 8% as our calculation from here on. So he earns Rs. 164,405 extra from an investment of Rs. 600,000 over 10 years. But that looks a bit low isn’t it? Can we do better?

I am assuming he wants to invest the same money (Rs. 600,000) for about same number of years (at least 10 years) and get same insurance cover (minimum Rs. 600,000). There are two parts to this investment. Part of the money needs to be for insuring his family/son against his sudden death. The remaining money can be invested in some other instrument. Remember, he might have applied for this ULIP to get tax benefit under the section 80C. So our proposed investment should also get benefits under 80C.

Insurance

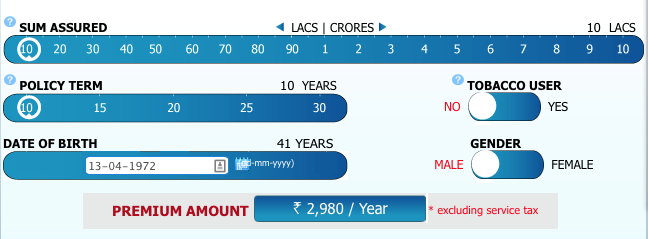

First, he should take a term insurance to protect his family in case of his death. Using HDFC Life’s Click2Protect calculator, for an insurance policy cover of Rs. 10,00,000 (the minimum available) and 10 years, he has to pay a premium of just Rs. 2980/year. Lets round it up to Rs. 3000 for easy calculation.

This is the amount he needs to pay for just insurance and he gets extra cover of Rs. 400,000 than the ULIP. I would suggest he go for at least 15-20 years as his son would’ve just joined college (at age 17) when the policy term completes. If he dies at year 11 (age 52), his family would have no income as the kid hasn’t yet started earning. Increasing the term to 20 years would just increase the premium by extra Rs. 900 only (Rs. 3880).

But just for the sake of comparison with the ULIP let’s go with the 10 years policy of Rs. 10,00,000.

Premium paid: Rs. 3000/year.

Remaining money to invest: Rs. 57000/year.

Investment

There are many forms of investment under 80C, like PPF, Home loan principal repayment, National Savings Certificate, ELSS mutual fund, etc. Let me just take two of such investments. One is the most safest and the other will be investing in equities (just like the ULIP scheme). Lets see how they compare against ULIP.

Public Provident Fund (PPF)

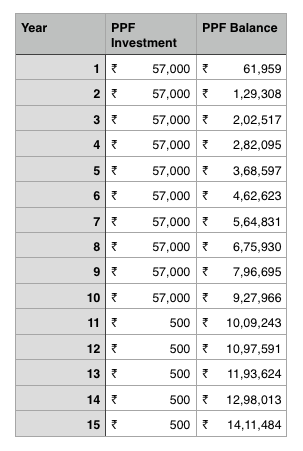

This is the most safest and best investment if you want assured returns. An individual can invest a maximum of Rs. 100,000 per year in it. He needs to be invested for minimum 15 years. However the minimum deposit needed to keep the account active is just Rs. 500. So lets assume he invests all Rs. 57,000 in PPF for 10 years and from year 11-15 he deposits just Rs. 500 to keep the account active. He can make monthly deposits of Rs. 4750 and his PPF account keeps accumulating all the money.

How much do you think the money grows to, if he puts in Rs. 57,000 per year till 10 years at the current rate of 8.7%? At the end of 10 years he would have Rs. 927,966 and if he just keeps putting in the minimum deposit for 5 more years, at the end of year 15 he would have a cool Rs. 1,411,484. What? 14 lakhs? That is more than double his investment, in fact Rs. 811,484 more than the Rs. 572,500 he puts in.

ELSS Mutual Fund

ELSS or Equity Linked Savings Scheme puts your money in the stock market and the government gives 80C benefits for money put in this scheme. Lots of mutual funds have ELSS schemes and while not everyone is good, there are some better performing schemes also. It is locked in for 3 years and since long-term capital gains in Equities aren’t taxable, any money he takes out after the lock-in period is totally tax-free.

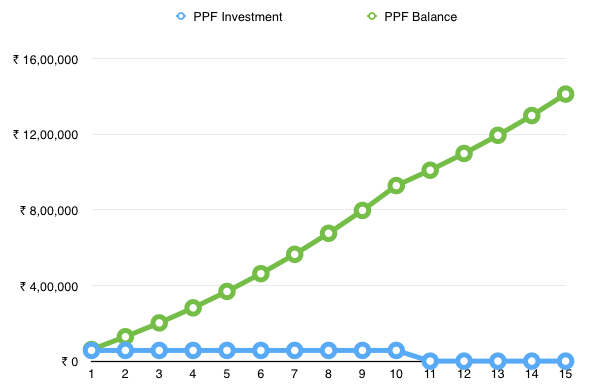

I know it is not fair to do an investment just based on previous fund performance, but we can’t predict the markets to do a future performance calculation too. So let me take a fund which has been in existence for at least 10 years and lets see how much a monthly investment of Rs. 4750 would’ve grown. I chose ICICI Prudential Tax plan and the investment was from April 1, 2004 to March 1, 2014. We stayed on this scheme throughout the bull and bear markets. This is just for a comparison and the performance might not be sustainable in the future and this isn’t a recommendation for this fund/scheme.

See how much it would’ve grown in 10 years? Rs. 1,208,195. Rs. 12 lakhs in 10 years. Which is significantly more than what he would’ve got in PPF (remember it was just Rs. 9.27 lakh in 10 years). Even more interesting is, how it is phenomenally more than what he would’ve got if invested in the ULIP’s feeble 8% rate. Plus ELSS has the lowest lock-in period of just 3 years among all 80C investments.

Even assuming that ULIP gives better than the 8% rate, lot of the initial money he invested goes into managing the fund, agent’s fees, etc. But direct investment into ELSS means no such losses and all his money is invested under his name. So it’s returns will be definitely less than you investing directly in other mutual funds.

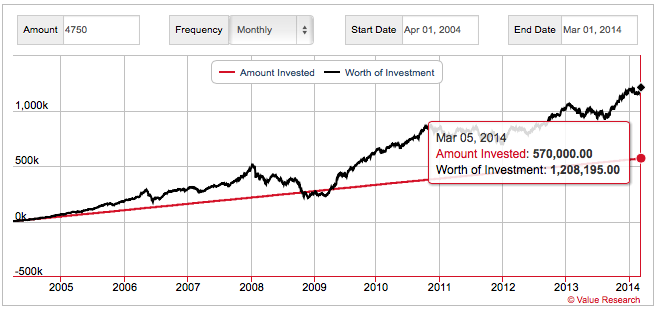

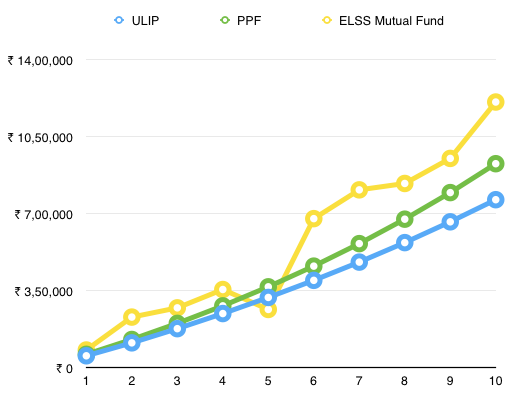

How does all three options stack up?

At the end of year 10, his investment in the three options will have grown to Rs. 7,64,405 in ULIP vs Rs. 9,27,966 in PPF vs Rs. 12,08,195 in ELSS Mutual Fund (based on past performance). Even if we add 1 or 2 lakhs to ULIP because the markets might have performed well, it would be definitely lower than investing on your own.

| Year | ULIP | PPF | ELSS* |

|---|---|---|---|

| 1 | 55195 | 61959 | 81487 |

| 2 | 114011 | 129308 | 231046 |

| 3 | 178432 | 202517 | 273011 |

| 4 | 247092 | 282095 | 356335 |

| 5 | 320285 | 368597 | 265687 |

| 6 | 397984 | 462623 | 678394 |

| 7 | 480893 | 564831 | 809133 |

| 8 | 569413 | 675930 | 838142 |

| 9 | 663886 | 796695 | 952014 |

| 10 | 764405 | 927966 | 1208195 |

What if he dies before 10 years?

Now lets see what happens if he dies before the term completes – for example, on the last month of his 10th year into the policy/investment.

ULIP

From seeing the official illustration of the ULIP application, I see that on death the nominee gets back just the insured amount, in this case Rs. 600,000. If he happens to die on year 9 the payout is Rs. 663,886 and on year 10 is Rs. 764,405 if the fund performs at 8%. His family doesn’t get anything more than that.

Term Insurance + PPF

If he had invested as suggested above, his insurance is separated from his investment. So on death his insurance company will pay Rs. 10 lakh (remember how Rs 10 lakh was the minimum in term insurance). But his PPF account is separate and all his investments will also be available for the nominee immediately upon his death.

So if he dies on year 1, the amount received is Rs. 10 lakh + Rs. 61959 and on year 10 his son will get Rs 10 lakh + Rs. 927,966. Double Benefit. That is the advantage of keeping your investment and insurance separate.

Term Insurance + ELSS

The logic behind this is similar to Term Insurance + PPF. Only catch is instead of immediately getting the invested money, the nominee has to wait for a 1 year lock-in to complete since the buying of the original units by his father. His kid will get both Rs. 10 lakh from the insurance company and the money he invested in the mutual fund. He could let it grow in the same scheme or switch to a different scheme if needed.

How difficult to set this up?

Actually it isn’t that different from starting a ULIP. You can use the help of an agent or even do most of this online. Both your term insurance and PPF/ELSS can be setup to take money from your savings account automatically. Insurance payment is done once a year, so that is quite easy. PPF/ELSS has the advantage of investing either monthly as SIP or investing in lump sum each year.

Investing monthly is better as one doesn’t have to worry about cash crunch in a particular month. Rs. 4750 every month for some one who earns more than Rs. 60,000 every month isn’t a very high amount. Also SIP gives the benefit of Rupee Cost Averaging to get more units when the market is at the lows.

Verdict

Instead of accepting what an insurance agent (should we say “insurance seller”) says, it’s better to think on our own and see if we can get better returns. Remember “Do Not mix Insurance and Investment.” Next time someone tries to sell you an insurance policy, ask them how they can give better returns & coverage than your own term insurance + investment plan.

Ask them to give in writing that their plan is safer than term insurance + PPF or gives better returns than term insurance + ELSS. I am sure no insurance agent will be able to do it.

TL;DR

If you want safe returns: Buy a term insurance and invest the remaining money in PPF.

If you are willing to take some risks: Buy a term insurance and invest the remaining money in ELSS Mutual Fund.

If you want the best of both world: Buy a term insurance and invest half the money in PPF and remaining half in ELSS mutual fund.