Everyone knows that equity markets are quite volatile in nature. There are wide swings in the stock prices or the index values over a period of time.

From my previous post you should’ve known that I invested in various mutual funds when the market was peaking out in the end of 2007. After January 2008, the markets crashed and I didn’t invest even a single rupee.

Instead if I had put in all my money in October 2008, I would be sitting on a nice profit. Unfortunately, hindsight is always 20/20. No one could’ve known that the market was going to crash in January and it reached the bottom in October. Contrary to what anyone may say, no one can time the market.

What else can you do instead of trying to time the markets? Everyone wants to buy at the lows and sell at the highs, right?

Rupee Cost Averaging

In simple terms, you invest a fixed amount and buy stocks or a mutual fund for that amount every month. The number of stocks or the units of the fund will vary every month due to the volatility in the market. But over the longer time period, things will average out and you will end up with higher profits than investing in lump sum. This is called as Systematic Investment Plan or SIP for short.

Lets see an illustration with some sample numbers. You are willing to invest Rs. 10000 per month in a mutual fund scheme (for a year). The NAV of the mutual fund will vary over the period of time. Lets see how many units of the fund you get every month.

| Month | Investment | NAV | Units Allocated |

|---|---|---|---|

| January | 10000 | 10.2 | 980.39 |

| February | 10000 | 12.4 | 806.45 |

| March | 10000 | 12.2 | 819.67 |

| April | 10000 | 11.9 | 840.33 |

| May | 10000 | 11.6 | 862.06 |

| June | 10000 | 10.5 | 952.38 |

| July | 10000 | 11.3 | 884.95 |

| August | 10000 | 10.9 | 917.43 |

| September | 10000 | 11.5 | 869.56 |

| October | 10000 | 11.1 | 900.90 |

| November | 10000 | 12.0 | 833.33 |

| December | 10000 | 13.2 | 757.57 |

| Total | 120000 | 10425.02 |

By investing a small amount every month, you would’ve around 10425 units of the fund invested at an average rate of NAV of 11.57.

Lets assume you instead put in the entire Rs.1,20,000 at the average NAV 11.57, your account would have only 10371.65 units. You got 53.36 units for free by spreading out your investment. This is free money with no work done on your part. Who doesn’t want this? This will be even more when invested in the longer time frame.

This number would’ve been even higher if it was a bear market and every month you keep getting more units than the previous month. Of course, this means in a bull market you lose out on the opportunity of investing in bulk at the beginning. But no one knows if we are currently in a bull market or a bear market, as its all in retrospective.

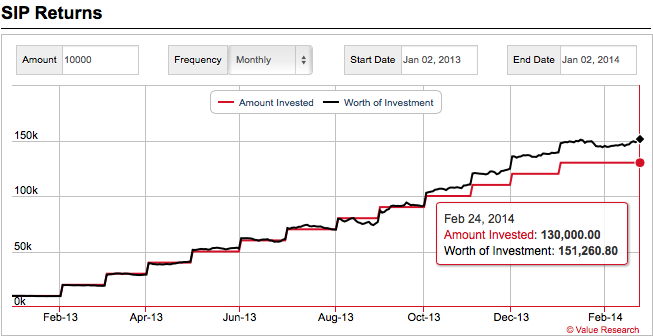

Here is a nice graph of a real world fund which shows how SIP gives you a better return. Investing Rs.10000 every month for a year from Jan 2013 to Jan 2014 (13 months), we have made a decent profit. Part of the profit is due to the fund’s performance and NAV increase and part of the profit is also from the SIP.

SIP works out as a nice hedge against wide fluctuations in the market and also makes sure you keep investing in the market whatever happens – as in equity only long term counts.

So, if you are salaried and has even a little bit of surplus cash, go start an SIP on a good mutual fund and invest every month. It doesn’t matter what happens to the market every day, you will be profitable in the longer term. Even if you aren’t salaried, invest regularly instead of trying to time the markets.

[…] every Indian blog about investing in stock markets gives this example and I also post this here as requested by a reader. A lot of people think that it is a lie and don’t believe it, but it is possible and there […]

[…] every indian blog about investing in stock markets give this example and I also post this here as requested by a reader. Lot of people think that it is a lie and don’t believe it, but it is possible and there […]

[…] every indian blog about investing in stock markets give this example and I also post this here as requested by a reader. Lot of people think that it is a lie and don’t believe it, but it is possible and there are […]

[…] every indian blog about investing in stock markets give this example and I also post this here as requested by a reader. Lot of people think that it is a lie and don’t believe it, but it is possible and there are […]

[…] every indian blog about investing in stock markets give this example and I also post this here as requested by a reader. Lot of people think that it is a lie and don’t believe it, but it is possible and there […]

I will post it as an article with the exact numbers of how it grew so much.

Hello Sirini, Read in your article that

“The famous example always given is “if you bought 100 shares of Wipro for Rs. 100 each (Rs. 10,000 investment) in 1980s, it would’ve grown more than Rs. 395 crores by the year 2010.” Phenomenal growth by just staying invested in 30 years”.

Just curious to know that how it made that much amount ….. For ex- total value during its inception is Rs 10,000 and now it say one scrp it goes around 500, it should be 500*100=50000Rs or increasing by percentage also it would be a couple of times doubled, but dont expect to come to 395 crores. So wondering how and what made that big amount … any insights ?

Thanks You very Much Srini…

Hi Rajesh,

I don’t know the difference in brokerage rates between ICICI vs other third party brokers. But usually I don’t prefer these bank+brokers. I had a SBI 3-in-1 account and the software support was (is even now) terrible. Also the brokerages was almost double than what I got from a third party broker. Also you can easily negotiate better brokerage rates with third party brokers than with banks.

As far as brokers are concerned, as long as they are registered brokers everyone comes under SEBI. No one can cheat you and go off. Just see which broker gives you good software support and good connectivity/telephone support to trade. Most big brokers give that. If you are feeling jittery about 3rd party then stick with your plan of ICICI.

Except for the brokerage, all other taxes (STT) & education cess and stuff are fixed by the government. They can’t charge more on that part. Just try to negotiate a good brokerage rate if you trade often.

Hello Srini… did you have a chance to check this ? Awaiting your precious reply …:-)

Thanks you very much sir and i have really missed this. I currently have an India Info Line and have closed this third party stock broker. I m planning to open the demat with the ICICI.

Just wanted to confirm if they are good and its transaction percentage is par with their counterparts. And any additional charges they imply on us, As said, planning to have the NiftyBees and any other C category scripts (i.e. around 50 or 100 Rs) that you would suggest for ?

Its just like everywhere else.

Profit = Selling Price – Cost Price.

Eg: Cost to acquire 1 stock of the company = Rs.100

Selling price after 3 years = Rs. 500

Profit is Rs.500 – Rs.100 = Rs. 400.

Now where does compounding come into the picture, you might ask. It is built-in to the business. You should remember a stock is buying a share of the business and not just a piece of paper/a line in DeMat account. When the business is doing good and earning nice profits, it will take part of the profit and put it back into the business to grow it.

Your investment automatically compounds as long as the business makes profit.

Have one small clarification. How do we make profits in equities in the long term ? what is the strategy behind it ?any formluaes? does it involve compounding and if so how ?

If after 10 years you have 1000 units of Nifty BeES, your investment grows as long as nifty grows.

For example, in 20 years from now nifty bees is at Rs.2000 (assuming nifty is at 20K), then your investment is 1000*Rs.2000 = Rs.20 lakhs. Best part is since its a long term investment, you don’t have to pay tax when you sell this.

If you keep investing more or higher amount as your salary increases, you will get even higher returns.

Overall compared to any other form of investment (FD/PPF/etc), equity markets provide higher than average when invested for a long term.

Great Thanks … That was awsome…. QQ… So investing till 10 yrs and not investing after it; and not taking the money from it post 20 yrs(total 30yrs), will the money in return grow compounding or will only raise as per the scrip value ? Thanks ….

We can’t predict how the markets will move in the future. But if you want to know how the monthly investment would have worked for past historical data, you can goto this page http://www.moneycontrol.com/mutual-funds/nav/goldman-sachs-nifty-exchange-traded-scheme/sip-calculator-MBM001.html and put in your numbers and you will get the current value of your investment. Eg: putting in your example from Feb 2004 – 2014, investing 7.2 lakhs grows your money to 12.38 lakhs.

Investing monthly in Nifty BeES is a good and safer way to getting your feet wet in equities market. Do remember, the longer you keep your money in the market, the higher the returns are. So, if you invested for 10 years and didn’t even put in a single rupee in the market after that, you will get a nice profit by the time you retire (assuming you are pretty young now).

Great Thanks … will wait to know more then 🙂 … just a QQ… I am planning to invest in NiftyBees monthly for rs 6000 (i.e. around 10 scrips a month) for a period of 10+ yrs. Do you suggest it is a good move and worth doing so ?

With the above said, just for the sake of math, at the end of 10 yrs, i would have invested around rs 720,000 to rs 750,000 with around 1200 scrips totally. I am aware that we cannot justify or expect anything precisely. Is it poss to analyse determine what would be the total earned at the end of said 10 yrs at the rate of 12% for the above? Thanks … .

Long term equity investors make money by two ways:

1) Dividends. Good companies give part of the profit earned as dividends every year.

2) Capital appreciation. Say you bought a company’s stock when it was Rs.100 and after sometime it performed well and rose up to Rs. 200. Your total value invested has doubled. There are companies which can give such multiples of return on investment, also there are companies which can erode your investment. It depends on which company you have invested in.

There are ways to analyse a company on the basis of how good and fundamentally strong the business is and the right time to invest in it. Will be writing more about these techniques in future posts.

That was really nice. Have one small clarification. How do we make profits in equities in the long term ? what is the strategy behind it ? does it involve compounding and if so how ?