A week back a caller to a Stock Market program in a local news channel asked the following question:

Instead of putting my money in Bank Fixed Deposits, isn’t it better to invest all my money buying bank stocks? After all stock markets give better returns right?

Hearing that made me go

There are three things wrong in that guy’s thought process. Lets see that in the reverse.

Stock Markets give better returns

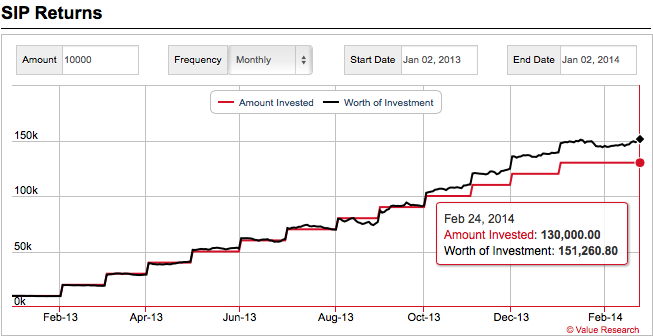

Yes. It is true that Equity is the best form of investment which can beat inflation. But you need to remember that it works that way only in the long term. If you are thinking of putting in money and taking it out for some urgent personal expense within a year – please run away from equities. Anything less than 7 years isn’t long term enough. For some sectors or stocks even that isn’t a good enough time period. Short term volatility will give you heart aches.

Usually people investing in fixed deposits look at a time horizon of 1-2 or maximum 3 years. Of course you can invest for a maximum of 10 years in FDs, but normally people don’t do that.

You need to also remember that, even though stocks give higher returns, FDs have fixed returns. Whatever happens to the stock price, you will get assured returns of around 8-9%.

Invest all my money

This is classic mistake that people do when they hear of the phenomenal returns given by a few stocks. They put in all their money into equities. Even worse they put all their money in a specific sector or even a single stock.

I have heard of people saying “Banks are very important to an economy and its not like they will shut shop. Let me put in all my life savings in buying bank stocks”. Lot of investors have their own favourite stocks/sectors and its driven by nothing logical/fundamental other than hearing their friend or neighbour talk about it.

Remember the saying “Never put all your eggs in one basket”. Putting all your hard earned money in a single instrument is dangerous. A single bad news and your favourite company’s stock might never recover back to its highs. The same rule applies to equities/debt/gold/real estate.

You should learn to diversify your investment across different asset classes based on your financial goals, age, retirement year, etc.

Stocks instead of Bank Deposits

First understand the basic difference between a Fixed deposit and buying a stock. When you deposit money in a bank FD account, you are giving permission to the bank to lend it to other borrowers. You are loaning the money to someone else through your bank. The borrower pays an interest for the money borrowed to the bank, the bank takes a percentage as its profit and pays the remainder as interest to you at the end of the term.

When you buy a stock of a company (a bank in this case), you own a part of that company/business (that’s why it’s called a share). The money you put in has now become the actual company itself. The only way you will make a profit out of your investment is when the company’s performance is good.

If the company runs into a rough patch and is making losses and finally shuts down, your investment is all gone (at least mostly gone). But if you had a FD in that bank, the bank tries to makes sure that your money is returned back to you before it can pay back its investors.

Also RBI (Reserve Bank of India) makes sure that all depositors are protected by an insurance up to a maximum of Rs. 1,00,000. So even if the bank shuts down without recovering its loans, Rs. 1 lakh of your deposit & interest is safe. Such insurance isn’t available in the stock market, thus making it a riskier mode of investment for your money. But remember with higher risks you also get the benefit of higher rewards.

So, next time you hear someone asking if putting their money in FD or equity is safer, you know what to reply to them.