There are very few bank based savings options available for general consumers and the most popular amongst them are Fixed Deposits and Recurring Deposits. Today lets see the basic difference between FDs and RDs, which gives better returns and when to use what.

Why do banks ask for Deposits?

First understand why banks needs deposits. Only with the money you deposit, banks will be able to lend money to people who ask for loans. They will give loans at a higher rate of interest than the rate of interest they give for deposits. This difference between the rate of interests is what earns profits for the banks.

Fixed Deposits

When you create a Fixed Deposit account, you deposit a fixed amount of money for a fixed period of time. And the bank provides a fixed rate of interest for that period of time. The rate of interest is usually higher than savings accounts as you have been locked into that account for the term. So they are also called Term Deposits.

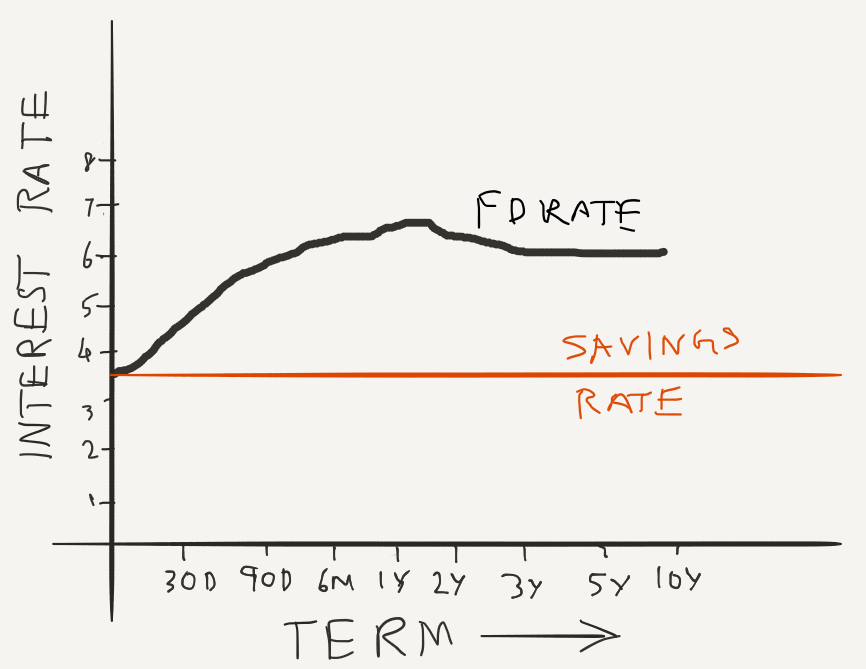

The minimum tenure for fixed deposits are 7 days and the maximum is usually 10 years. For terms spanning few days, the rate of interest will be very similar to Savings accounts. As you go to a year or more, the interest rate hits a peak and beyond 2 years, the rate decreases slightly.

If you plot the graph of interest rates, you would get a curve like this.

Even though the money is locked into the bank for the term, you can withdraw the money prematurely if you agree for a slight penalty in the interest rate. The penalty is only on the interest you earn and not on the actual money you put in. So you don’t have to worry about liquidity of your money.

Recurring Deposits

When you start a Recurring Deposits (RD) account, you agree to deposit a fixed amount of money every month on a particular date and agree to withdraw it after N deposits are made. The rate of interest is also fixed when you start the account.

It is calculated on each installment you pay according to how many months it was with the bank. So if you start a 12 month deposit, the first installment will earn interest for 12 months and the last deposit will earn interest only for the last month.

RDs always has a minimum of 6 months of investment period and can go upto a maximum of 10 years usually in multiples of 3 months. After the minimum 6 months is done, you can stop the RD any time you want.

Which earns higher returns?

This brings us to the main difference between both in terms of returns earned. Lets compare a fixed deposit of Rs.1,20,000 vs a recurring deposit where you deposit Rs.10,000 every month for 12 months term.

I am using a calculator from HDFC Bank website and currently the rate of interest is 6.9%. You can put in your numbers and get your results. Calculator for FD and RD. At the end of 1 year, the FD will have a maturity of Rs.128497.00 and the RD will have a maturity of Rs.124589.00. The difference of the interest earned is almost twice in FD vs RD.

This clearly shows that FDs will always have a better return since you have deposited all the money at the beginning of the term vs monthly.

Other advantages of FDs

FDs also has other advantages. You can choose a much smaller term (like few days) than RDs (minimum 6 months). And you can also prematurely break the FD and withdraw your money.

FDs also has the advantage of quarterly or monthly payout. This is useful for senior citizens who have large deposits and would like to get back a fixed monthly income from the deposits. But the best way to “invest” in FDs is to let it compound (by default quarterly) so that even your interest earns interest over a time period.

The most important benefit I could see from FDs are the sweep-in account where you link your savings accounts with your FDs and can sweep in excess balance into FDs and back into savings account whenever you need it.

Advantages of RD

So does that mean Recurring Deposits doesn’t have any advantages? No. They are very useful for people to start getting into the practice of regularly saving every month. If you setup a RD to take away money from your salary account at the beginning of every month, you will soon get used to having lesser money in your account and naturally your expenses will come down.

In fact, investing in RDs was how I introduced the savings habit for my wife. In the beginning when she handled her finances herself, I made her to put in a RD on the 5th of every month. And naturally this built up a nice corpus of money which was useful when we needed the money.

Now since she has gotten into the habit, she has progressed into SIPs and investing in equity mutual funds for long term wealth creation. She still has an RD account to save up money for vacations.

Which brings us to the next point of saving up money for short term expenses. Some might have planned for a vacation in the next 6 months or might have marriage or educational expenses in a year or so. For salaried individuals with such tight deadlines, it is easier to start an RD account which automatically debits the account from their salary accounts. Unless you are in the top tax bracket, RDs are good enough instruments to save money.

Conclusion

Finally it comes down to what you capabilities and goals are. Whether you have a bulk money to invest in? or want to invest monthly for some short term goal. Choose the right deposit type for the right goal.