The past few articles we have seen how we can invest your money and also save tax under 80C using ELSS Mutual Funds, PPF, EPF, NPS and also Life Insurance. But 80C isn’t limited to just those schemes.

There are a few investment options which also enjoy 80C deductions.

Investment in House

Lets say you buy a house and like most of us middle class people, you will take out a home loan to buy your house. There are two ways you can get benefits under 80C.

Stamp Duty paid for Registration:

Registering a house involves paying Stamp Duty to the government. The stamp duty you pay and the amount paid for the registration of the documents of your house can be claimed as a deduction under 80C on the financial year when you purchase the house.

Home Loan Principal repayment

Home Loan means paying EMIs. Every month you are paying a fixed amount of money which go into servicing your loan. Your monthly payment has both principal component and interest component. In a financial year, all the money you paid back as principal enjoys deduction under 80C.

Remember in the initial few years of the loan, the principal component will be a very small amount vs interest paid. But the interest component can also help to significantly save your taxes, but that is under Section 24.

National Savings Certificate

National Savings Certificates or popularly called NSC is a savings bond and is part of the postal savings system. Anyone can buy a NSC from a post office in their own name or in the name of a minor. They have a maturity of five or ten years. The interest earned is liable to tax (taxable under your tax slabs). But since the interest is also reinvested, that amount can also be eligible for tax deduction under 80C.

Infrastructure Bonds

These are also popularly called Infra Bonds. These are issued by infrastructure companies, and not the government. Since this investment is helpful to build and develop the infrastructure of the country, you can claim a tax deduction under 80C.

Sukanya Samriddi Account

This is a new savings account introduced by the government couple of years back. This is applicable specifically for parents of girl child. This account can be opened if you have a girl child from the day of birth of the child, till she attains the age of 10 years.

The minimum deposit is Rs.1000 and maximum of Rs.1.5 lakh can be deposited in one financial year. Interest earned is fully tax exempt. The account can be closed after the girl has completed 21 years of age. Normal Premature closure will be allowed after completion of 18 years provided that girl is married.

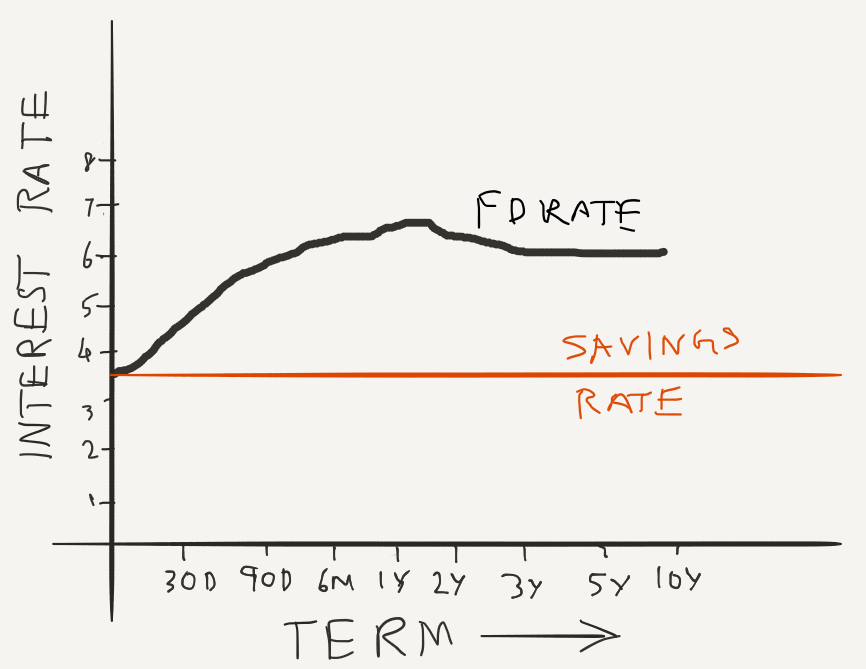

Tax Savings Fixed Deposits

Banks provide a special type of fixed deposit scheme which has a lock-in of 5 years. The money you invest is tax exempt, but the interest earned is taxable at your tax slabs.

Senior Citizen Savings Scheme

This is a special scheme for senior citizens and this is available for anyone who has completed 60 years of age. There are also other age criteria for people who have retired under Voluntary Retirement Scheme or Defense personal.

The maturity period is 5 years and any number of accounts can be opened. The important difference between this and tax savings FD is the interest earned is credited back into your savings account every quarter instead of reinvesting back.

After maturity, one can also extend it further by three years.

Children’s Education Expenses

If you have children, any money you spend on their education like school or college fees can be claimed for tax deduction under 80C.

These are all the different possible tax deductions under 80C. Next article is about how to save tax on Medical Insurances under section 80D.