A lot of people don’t understand the difference between Service Charge and Service Tax levied in Restaurants and end up questioning (even fighting) with the restaurant manager. This is becoming more of a problem now that the Government has said that the public doesn’t have to pay Service Charge if they are unhappy about the service.

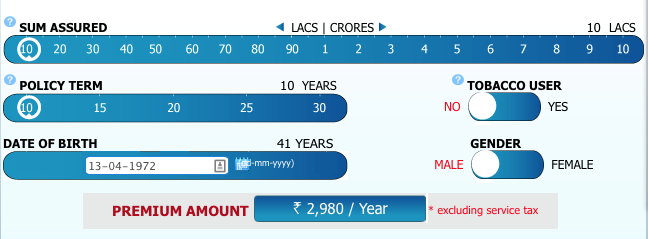

Lets clear this quite popular and controversial question for all. Let me draw a sample restaurant and bar bill. Lets assume you had some food for Rs.1000 and some cocktails for Rs.1000. Now how much extra are you going to pay and to whom does this money go to?

| Particulars | Amount |

|---|---|

| Food | 1000 |

| Alcohol | 1000 |

| Sub Total | 2000 |

| Service Charge (10% of sub total) | 200 |

| Service Tax (5.6% of sub total + service charge) | 123.2 |

| Swacch Bharat Cess (0.2% of sub total + service charge) | 4.4 |

| Krishi Kalyan cess (0.2% of sub total + service charge) | 4.4 |

| VAT (12.5% on food items) | 125 |

| VAT (20% on on Alcohol) | 200 |

| Total | 2657 |

Service Tax

Service tax is a levy collected by the Central Government for the provision of certain services. The service tax has to be paid by the service provider to the government, and in turn the service providers pass on the amount to the customers.

Taxable services include travel agency, courier services, chartered accountancy, banks, fashion designing, internet cafes, cab rentals, architectural services, telecommunications, and health clubs. Applying service tax on restaurant bills is slightly trickier. If the restaurant has only a non air-conditioned room for its patrons, they don’t have to pay service tax to the government. But if they have a air-conditioned room, they will have to pay service tax to the government even if you didn’t eat in the air-conditioned room. The government wants its money from everyone they can get their hands on.

As of FY 2016-17, the Service Tax component is 14% and it the same across India. Add on a Swach Bharat Cess (money that the government should use build a cleaner India) of 0.5% and a Krishi Kalyan Cess (for improving agriculture and farmer’s welfare) of 0.5%. The total service tax you would have to pay is a round 15%

For restaurants, it is still tricky (they don’t want us to eat in peace, do they?). The government has decided that of the entire amount 60% of it is raw materials of the food/beverage and remaining 40% is the service part. And it makes sense to only levy service tax on the 40% service part, right?

So applying 15% of service tax on 40% of a total comes to another round 6%. Eg: Lets say you eat something for Rs.100. You have to pay 15% service tax on 40% of the Rs.100 = 15% * Rs.40 = Rs.6. This Rs.6 is paid by the restaurant to the government.

Do remember to check for the service tax number at the top of the restaurant bill. If it isn’t mentioned, the restaurant has no business charging it and they might just pocket that money.

Value Added Tax

Value Added Tax or VAT as it is popularly called is levied on any item that are sold in an improved form, meaning some value was added before selling to you. Lot of goods and services are charged VAT at various stages before it reaches the consumer.

In restaurants, VAT is not chargeable on packaged items such as drinking water, bottled alcohol and food. But it is applicable on food and drinks/cocktails prepared in the restaurant kitchens/bar.

VAT is a state tax, so the rate differs from each state and on the type of product. VAT on food items might be different from VAT on alcoholic beverages.

Service Charge

Now coming to the controversial part of the bill. Service Charge is NOT a government charge. It is just another fancy word for Tip. In many countries the waiters and restaurant staff are not paid enough and have to live on the tip they receive from the patrons. It is common to pay anything from 10%-25% of the total bill in those countries.

Now in India since there are no strict working hours, many restaurant staff work for more than 14 hours daily. And naturally they aren’t be paid hourly wages and the salary depends on your experience.

Only a very small percentage of people give tip and the restaurant either had to pay more salary or lose the employee. Some high-end restaurants began charging a mandatory 5% or 10% service charge so that the customers clearly know how much money they are giving to the staff.

Few years back only very few restaurants added a service charge and it was reasonable. People were also happy with the service received to give that service charge. But there are a few restaurants who became greedy and since customers weren’t educated on the difference between service charge vs service tax, began to add more service charge even without providing good service.

So the government had to come in and regulate this saying if the customer felt that the service he received wasn’t satisfactory, he can refuse to pay the service charge.

What will happen in the future?

Now whenever the government tries to regulate any free market, the market will course correct itself. With the new law if more and more customers are going to reject the service charge and also refuse to pay a tip because they are miserly, the restaurant will increase the price of the food item. Instead of being transparent, now the price will be factored into the bill somehow.

People should be reasonable and if they liked the service of the wait staff, they should happily pay a nominal tip. That few hundred rupees you give as tip would make sure that the waiter remembers you and gives you better service the next time around.

Remember this the next time you eat and whenever someone is confused about the charges in a restaurant bill, point them to this article.