There are many corporate actions that a company takes that will affect the stock. Understanding the different corporate actions is important to help you determine whether to buy or sell the stock and how that action will affect you as a stock holder.

A corporate action is initiated by the board of directors, and approved by the company’s shareholders by voting on the issue.

Bonus Issue

When a company gives a bonus stock to it’s shareholders, it allots extra stocks to them. They are a gift to the shareholders for trusting and investing in the company. The bonus shares are issued out of the cash reserves of the company. You basically get free shares or equity against shares that you currently hold.

When a company gives a bonus stock to it’s shareholders, it allots extra stocks to them. They are a gift to the shareholders for trusting and investing in the company. The bonus shares are issued out of the cash reserves of the company. You basically get free shares or equity against shares that you currently hold.

They are typically allotted in fixed ratios such as 1:1, 2:1, 10:2, etc. When a company allots bonus shares in the ratio of 2:1, for each 1 share you hold, you get back 2 additional shares at no extra cost. So if you hold 100 shares of a company (current price of Rs.60) and the company issues bonus at 2:1 ratio, you will get get an extra 200 shares and the total number of shares you hold will increase to 300 shares.

Remember its only the number of shares that increase. The overall value of the investment will remain the same. After the bonus is given the price of the each share will go down by the same ratio. So the price falls from Rs.60 to Rs.20.

Rs.60*100 = Rs.20*300

Your value is the same. But you have just received free shares of the same face value.

Lets see some more examples:

| Bonus Ratio | No of shares before bonus | Share price before bonus | Value of investment | No of shares after bonus | Share price after bonus | Value of investment |

|---|---|---|---|---|---|---|

| 1:1 | 100 | Rs.50 | Rs.5000 | 200 | Rs.25 | Rs.5000 |

| 2:1 | 100 | Rs.60 | Rs.6000 | 300 | Rs.20 | Rs.6000 |

| 10:2 | 100 | Rs.100 | Rs.10000 | 500 | Rs.20 | Rs.10000 |

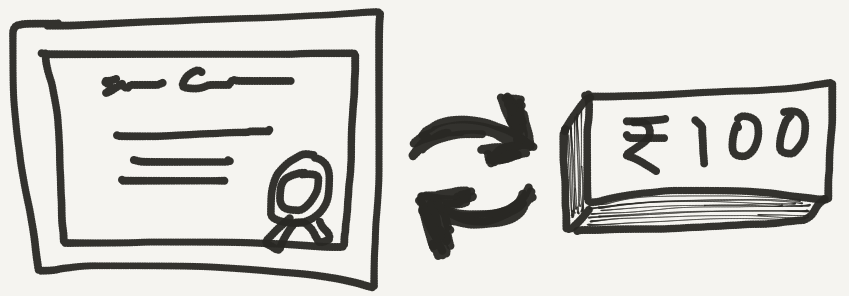

Stock Split

Stock Split literally means what you think it means. The stock is actually split. When a stock split happens, the number of shares held increases, the value of your investment remains the same. The only thing that gets split is the face value.

Stock Split literally means what you think it means. The stock is actually split. When a stock split happens, the number of shares held increases, the value of your investment remains the same. The only thing that gets split is the face value.

If a stock’s face value is Rs.10 and there is a 1:1 stock split, then the face value is now split into 2 (Rs.5) and for every 1 stock you hold, you will get 1 more extra stock. Since the face value is now decreased by half, the current price of the stock also falls by half. If the price previously was Rs.60, now it will be at Rs.30. So the value of your investment remains the same.

| Split Ratio | Old FV | No of shares before split | Share Price before split | Value of Investment before split | New FV | No of shares after split | Share Price after split | Value of Investment after split |

|---|---|---|---|---|---|---|---|---|

| 1:1 | Rs.10 | 100 | Rs.50 | Rs.5000 | Rs.5 | 200 | Rs.25 | Rs.5000 |

| 5:1 | Rs.10 | 100 | Rs.100 | Rs.10000 | Rs.2 | 500 | Rs.20 | Rs.10000 |

Rights Issue

This is also frequently seen in markets. Companies announce a rights issue to their existing stock holder. This is just a way to way to raise fresh capital. Instead of issuing a fresh IPO to complete strangers, the company does a rights issue to it’s existing shareholders.

The shareholders can subscribe to the rights issue, if they wish depending upon the proportion of their share holding.

For example if a company does a 1:5 rights issue, it means for every 5 shares you hold, you can subscribe to 1 additional share. The advantage here is you will be able to subscribe to the new shares at a lower price than the current market price.

But remember subscribing to all rights issue isn’t advisable even though you get shares at a discount. You should always look at the fundamentals of the company and what the company’s future plans are before infusing fresh capital into it. And remember, if the rights issue price is almost equal to the current market price, there is no use in subscribing to it.

Since fresh money is brought into the company and new equity is given to the shareholders, the price of the existing shares doesn’t get directly affected by this.

Buyback of shares

Some companies announces a buyback of shares, if it has excess cash reserves and wants to reduce it’s outstanding shares in the market. It will given announce a fixed amount for each share and shareholders can choose to give off their shares back to the company at that price.

Usually the price is slightly higher than the current market price so that it provides an incentive for the shareholders to use the buyback opportunity.

Usually the price is slightly higher than the current market price so that it provides an incentive for the shareholders to use the buyback opportunity.

Companies does buybacks for one or more of the following reasons:

- Consolidate the promoter’s stake in the company.

- Increase the promoter holding percentage thereby showing confidence to the other shareholders.

- Prevent competition from taking over the company.

- Also maybe delist the company at a later stage.

Fundamentally, these reasons show that the company is confident about itself. And this decreases the liquidity of the share and thereby increases the stock price. Another reason for the stock price increase is the market is usually efficient in matching the current price with the buyback price. So the price oscillates around the buyback price till the event actually happens.

Dividends

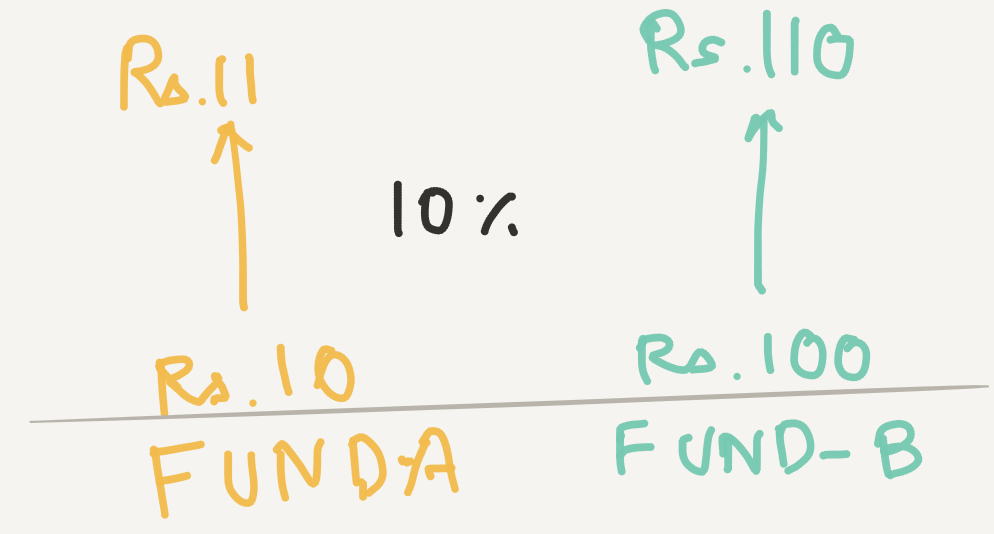

These are a portion of the profits that the company gives to it’s shareholders. Many companies typically give one or more dividends per year. They are announced as a percentage of the face value of each stock. So if a stock’s face value is Rs. 10 and the company announces a dividend of 100%, you will get Rs.10 as dividend for each stock you hold.

These are a portion of the profits that the company gives to it’s shareholders. Many companies typically give one or more dividends per year. They are announced as a percentage of the face value of each stock. So if a stock’s face value is Rs. 10 and the company announces a dividend of 100%, you will get Rs.10 as dividend for each stock you hold.

Rs.10 * 100% = Rs.10.

There are companies which doesn’t pay dividends too. That doesn’t mean they are not good companies. They just decided that instead of paying the shareholders the profits, they decided to reinvest the profits back into the business.

Also you should note that even if a company makes a loss for a year it can decide to give dividend from the excess cash reserves it has.

Since the company has given out money it has as dividends, the stock price would also reflect the new value of the company. So if a stock is at Rs.100 which announces a dividend of Rs.10, on the date the dividend is calculated (called ex-dividend date) the stock price will drop by Rs.10 (to Rs.90). So even if you buy a stock after the ex-dividend date, you get the share of the company based on what it was valid even after subtracting the dividend.

The only advantage of dividend is it is not taxable in the hands of the shareholder(up to a limit of Rs.10 lakh since 2016). So it was a good way to take some money out of the company for the promoters.

In the next article lets see what the different dates related to these corporate actions are and buying on what date lets you enjoy the benefits.

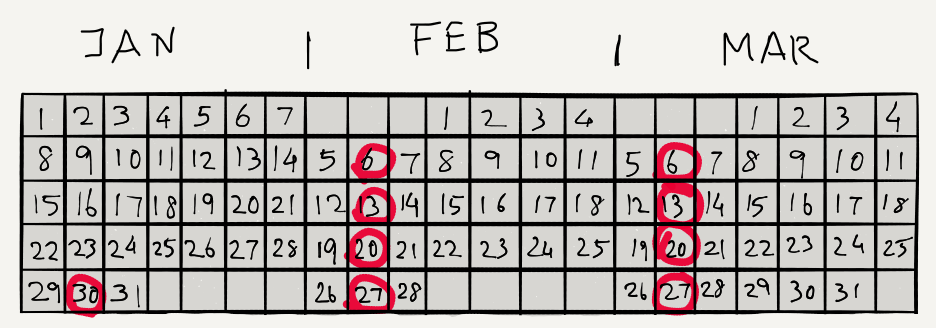

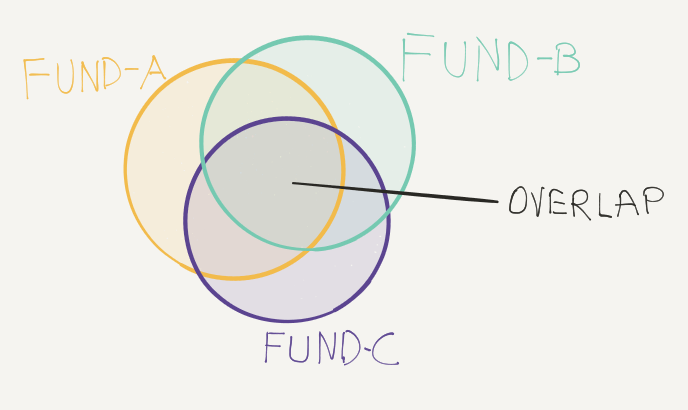

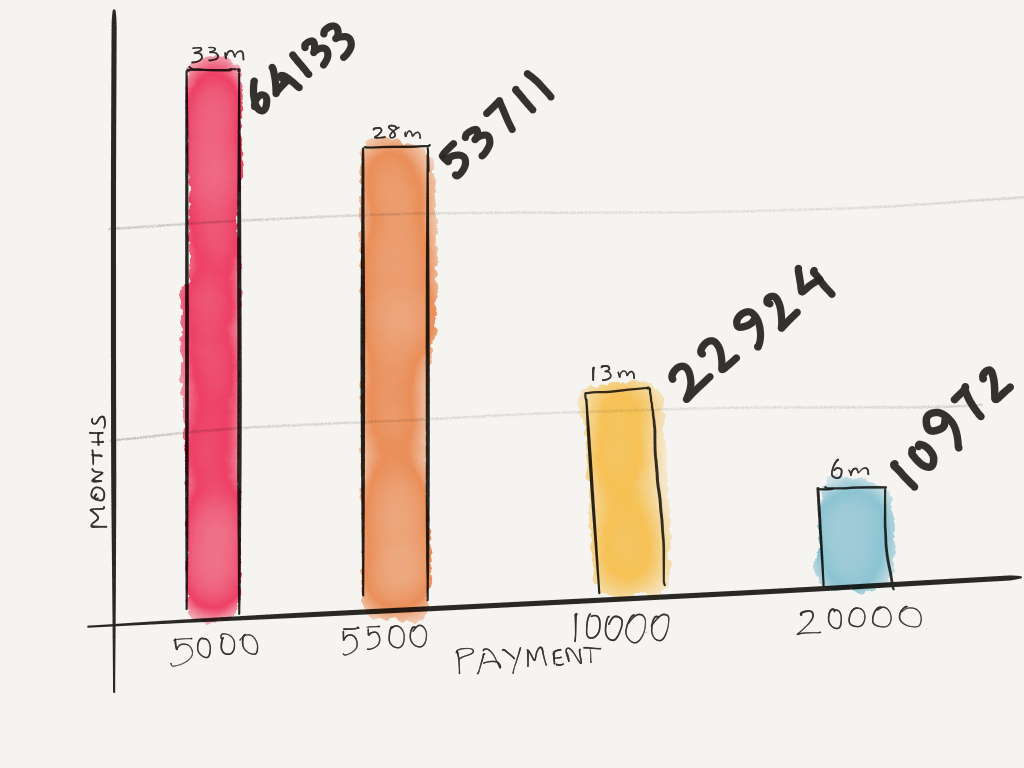

If you are a salaried employee, the next 1 month is when your company’s HR/Payroll department keeps bugging you for your tax savings. And many employees haven’t done any investments for tax savings for this year or haven’t completely maxed out your 80C. If you also belong to that camp, there would be some colleague or friend who would try to sell you some LIC policy or a ULIP policy. But you know that you handling your insurance and investment yourself will lead to much better returns than buying a ULIP at the last moment.

If you are a salaried employee, the next 1 month is when your company’s HR/Payroll department keeps bugging you for your tax savings. And many employees haven’t done any investments for tax savings for this year or haven’t completely maxed out your 80C. If you also belong to that camp, there would be some colleague or friend who would try to sell you some LIC policy or a ULIP policy. But you know that you handling your insurance and investment yourself will lead to much better returns than buying a ULIP at the last moment.